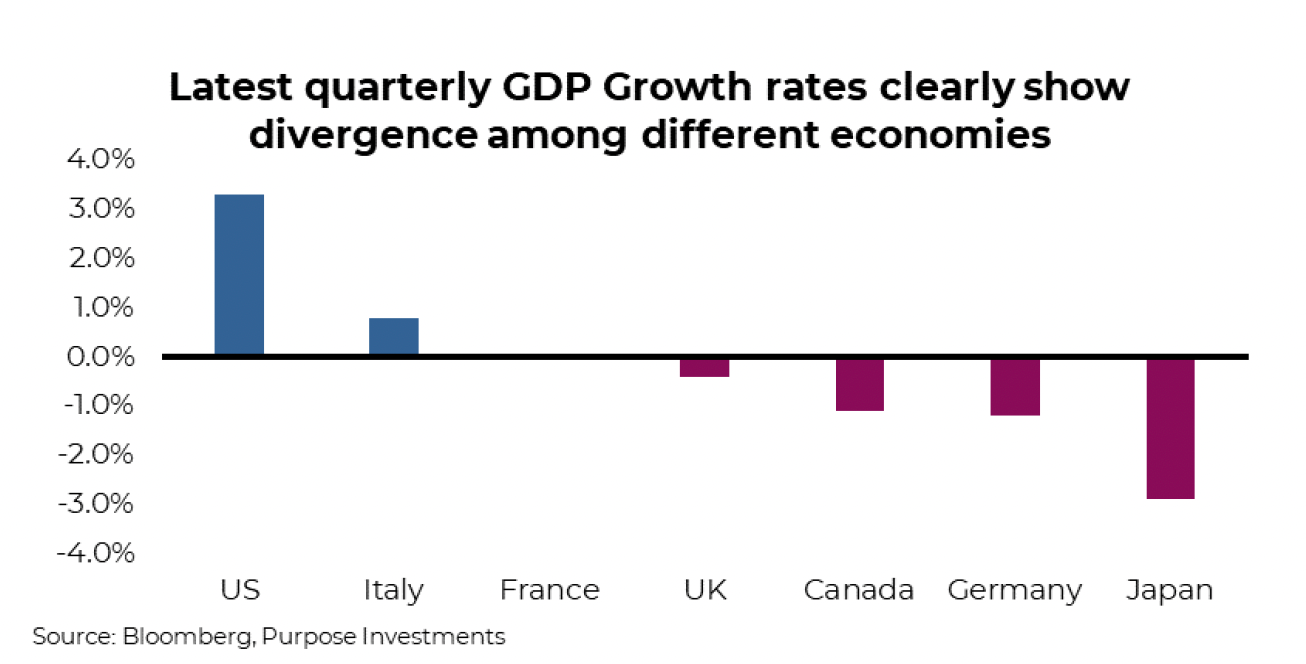

Over the past month or so, the economic data from America has certainly turned up somewhat. A strong Q4 GDP print of 3.1%, two back-to-back months of 300k+ job gains, and even manufacturing activity has ticked higher. So, where is this recession that has been the talk of the town for the past year or even longer? It appears to be almost everywhere else. Maybe not outright recession, but certainly weakness. The latest GDP readings are negative in the UK, Canada, Germany and Japan, leaving only two of the G7 members with positive economic growth.

Much of this divergence can be explained by two factors: economic sensitivity to interest rates and global trade. Countries that are more sensitive to rates and global trade are doing worse; those less exposed are doing better.

As we all know, rates/yields have moved substantially higher over the past couple of years, yet that impacts different parts of the economy differently. Based on different economic compositions from one country to the next, rate changes can hurt more or less. The U.S., for instance, is less sensitive to rates given the structure of their mortgage market. Dominated by 30-year fixed mortgages, changes in rates don’t impact consumers’ mortgage payments as much. It is estimated the U.S. has less than 10% of mortgages set to variable rates, compared to 30% in Canada. Furthermore, fixed mortgages in Canada max out at 5 years, meaning the resetting of higher payments is increasingly being felt as mortgages are renewed.

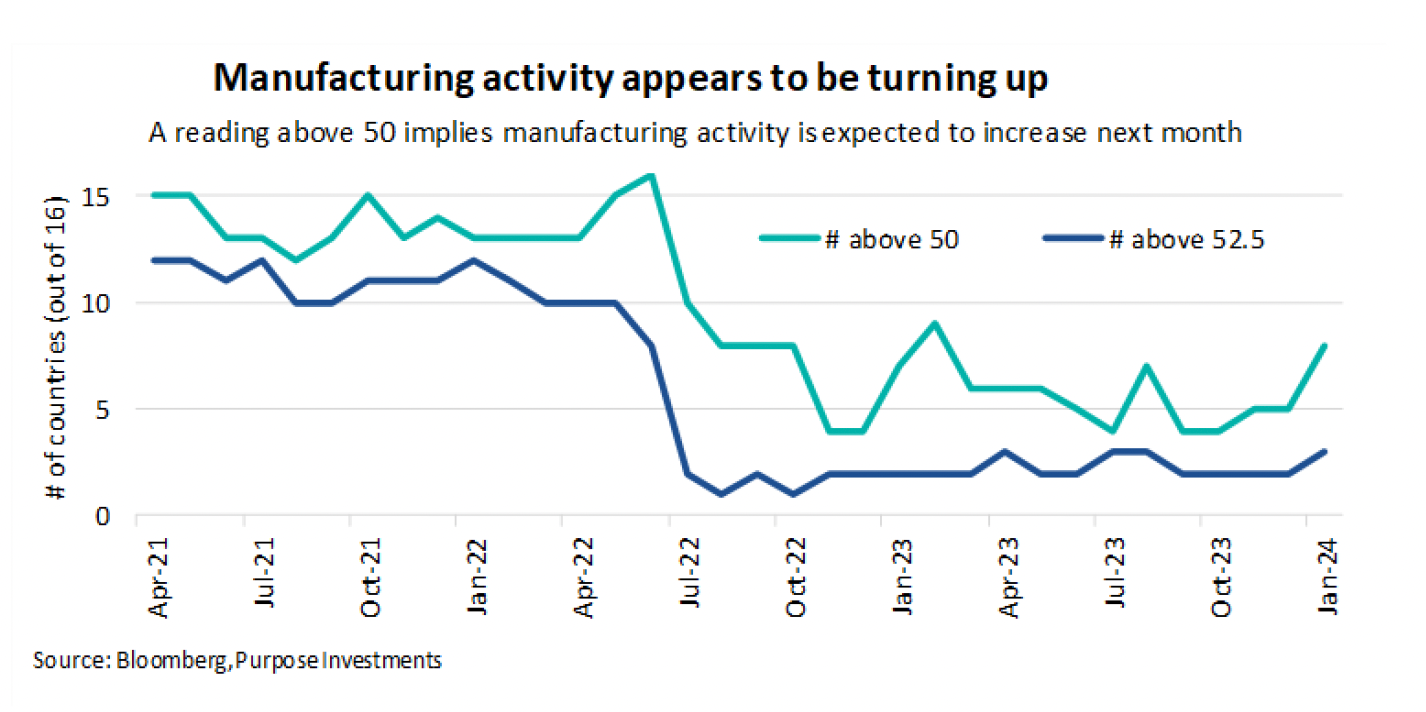

While encouraged, our view on manufacturing is tempered. Manufacturing activity exploded during the pandemic as we all wanted more goods. As the pandemic diminished, consumers returned to more normal spending patterns. So, that spike in 2021/22 was followed by a dearth in 2023. Global spending growth does appear to be slowing, likely a result of higher rates.

Wait for it, but we could be getting close to a period when good economic news stops being suitable for markets. This incredible run over the past three months has seen the S&P 500 rise 14 of the past 15 weeks – a feat not repeated since the early 1970s. The initial rise was from an oversold market that started celebrating more evidence that inflation was coming down, opening the door for rate cuts this year. This traversed from inflation optimism to optimism about U.S. economic strength. Unfortunately, strong economic growth does not give with rate cuts nor with inflation making a speedy decline down to the magic 2% realm.

Final Thoughts

The U.S. is the biggest economy in the world, and its equity market now carries about a 70% weight in the MSCI World Index. Yes, if you buy a passive cap-weighted global equity ETF, it's really just the S&P 500 plus some odds and sods. The U.S. economy could certainly remain immune to slowing growth elsewhere. Maybe the stock market can keep climbing with earnings growth slowing. However, the biggest constant for both markets and economies is often reversion to the mean. And both are well above their means at the moment.

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Greg Taylor and Derek Benedet Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be

construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.