We’re nearing that time of year. By the end of the month, we’ll be bombarded by pumpkin spice everything. We blame Starbucks and influencers for this trend. Pumpkin spice has been as synonymous with fall as crisp autumn air and changing leaves. Apologies for jumping the gun, but August is almost half over, and September is just around the corner.

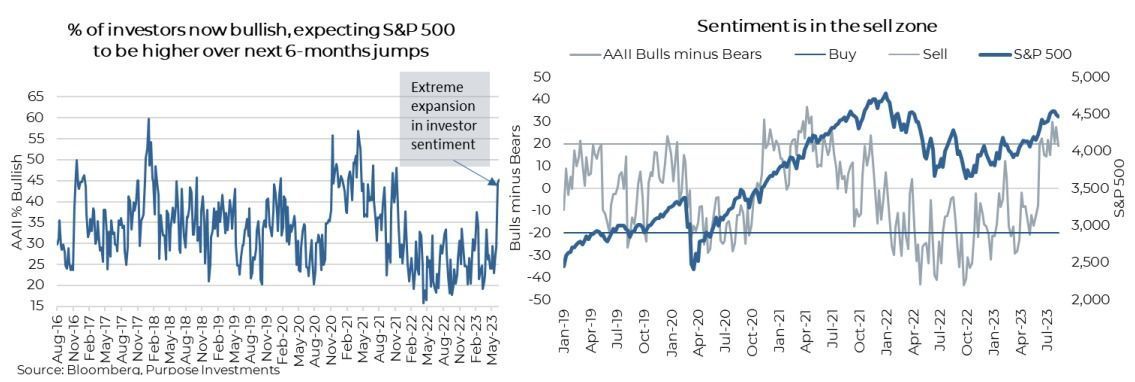

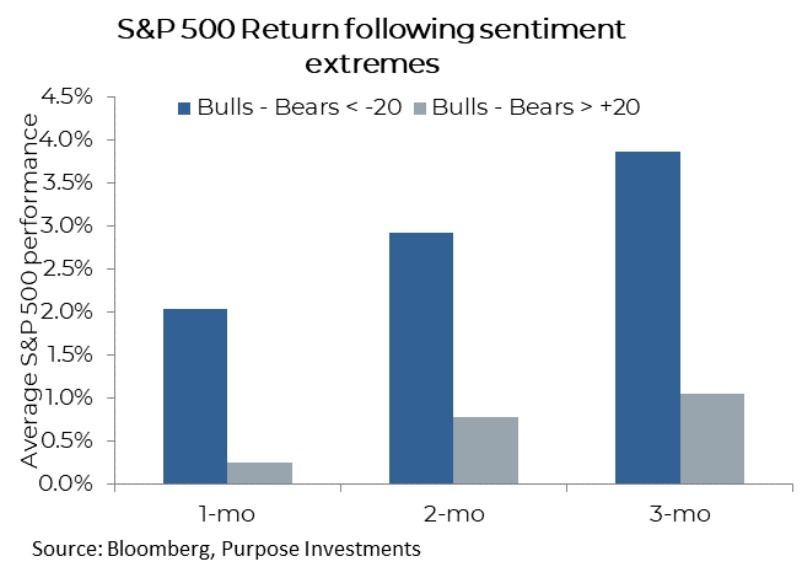

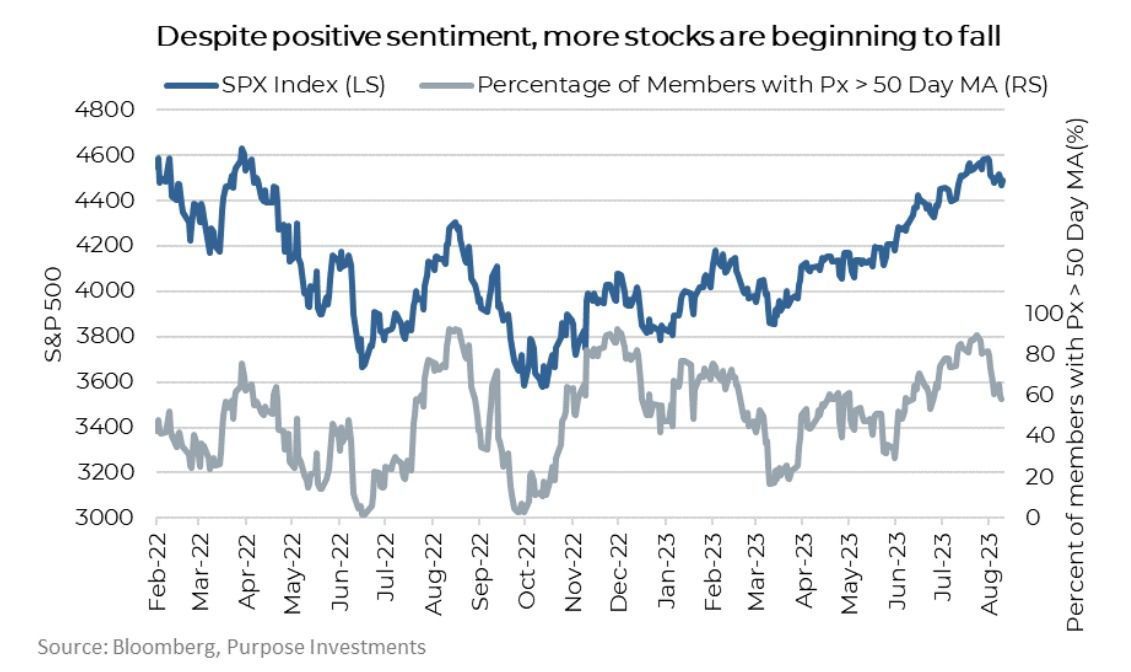

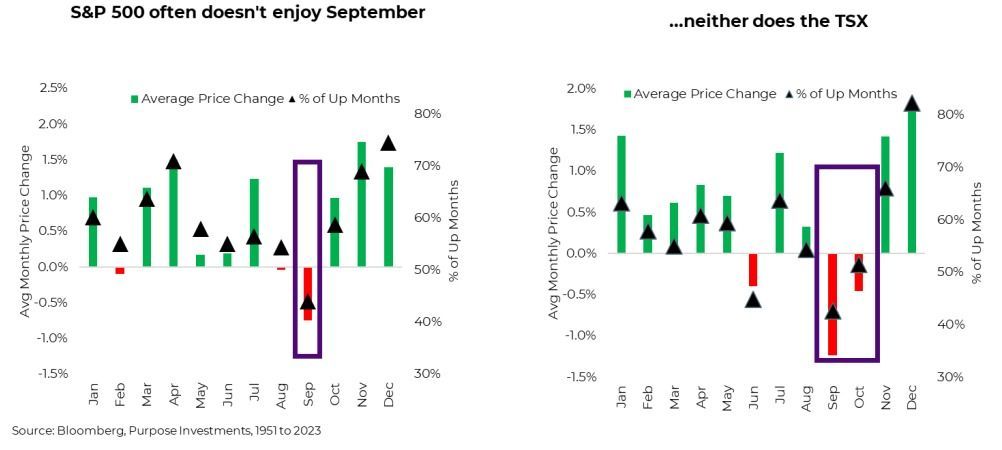

Besides stretched investor sentiment, one other potential risk on the horizon for investors is seasonality – whether real or perceived, seasonality and sentiment are inexorably intertwined. Bit of a chicken and egg situation, but market seasonality assumes some sort of repeating sentimental shift in risk aversion, which in turn affects prices. Seasonality in stock returns has been known for decades. As the chart below shows, average monthly stock returns are negative in September and extremely positive around the turn of the year. Going back to 1951, the average return in September in Canada is -1.2%, with just 42% of the months positive. December is the highest, with an average of 1.7% with a win rate of 82%. Now these are averages, so it’s not a guaranteed exploitable trading event, but the numbers are on your side to tread carefully and take some risk off the table. Anyone surprised if the market were to sell off in the next month or so is NOT a student of market history.

We’ve seen some research that attempts to attribute seasonality to Seasonal Affective Disorder (SAD). We’re certainly sad to see summer go, but the sad reality is that in September, trading desks are back at full staff, and real work gets done. More often than not, it seems it’s a time of profit-taking, de-risking, and of course, a pumpkin spice latte.

Final Thoughts

Sentiment is not the be-all and end-all of investing. If only it were that easy. But it is important, especially at extremes. The big question is whether or not we’re in a new bull market or is this just the mother of all bear market rallies. The market loves the soft-landing narrative, and given how well markets have performed the past few months, it's really taken hold. Looking at the global economic data, there is still enough ambiguity to not rule it out. For an investor, if you believe in the soft landing, it makes sense to rush into risk assets now before the data plays out. But this is simply greed taking hold. This still could be a big bear market trap, and given stretched sentiment and heading into the seasonal weak season for markets, we caution investors not to join the herd.

— Derek Benedet is a Portfolio Manager at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Marketing Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.