Perhaps one of the most pervasive ‘right calls’ that the market is now rewarding is the short duration stance within the fixed income portion of the portfolio coupled with underweights in traditional bonds. We believe this portfolio positioning to be pervasive based on seeing it in the VAST MAJORITY of investor portfolios and advisor models our team has had the opportunity to analyze. Add to this our own stance within multi-asset portfolios we help manage. Let’s all take a moment to pat ourselves on the back.

Short duration + underweight bonds = a WIN. The following chart shows the total return in the Canadian and U.S. bond markets using the more popular ETFs as proxies. Clearly, long bonds (long duration) have been the hardest hit. The universe held up a bit better but still down almost 7.5% over the past six months. While still down, short bonds held up even better.

It is pretty common knowledge why bond yields are rising. You can take your pick from the following reasons: the global economy is growing above trend, strong employment gains have created a tight labour market, inflation is high due to demand and supply issues, or central banks left the stimulus spigot open too long and are now reversing quickly to catch up...these are all known knowns.

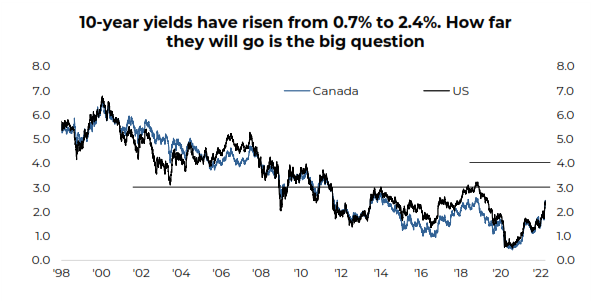

The portfolio construction call to be low duration and underweight bonds was very easy when 10-year yields were sitting at 0.7% in Canada and the U.S. Now at 2.45%, it is much more complicated. Unlike equities, when bond prices fall (yields rise), the future expected return on bonds automatically goes up. This raises an interesting thought experiment. There is a solid ‘buy the dip’ mentality for equities that has been reinforced over the past few years. Should this apply to bonds as well?

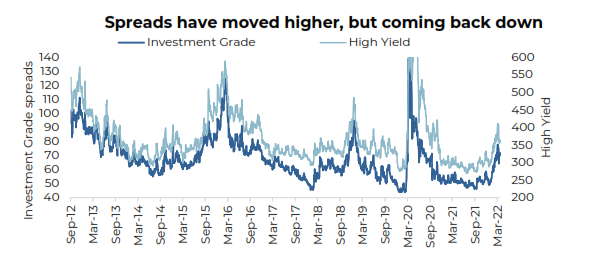

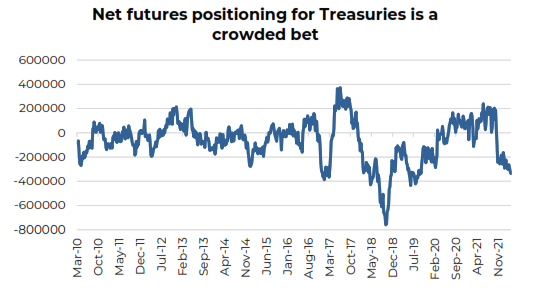

We are not going to pretend we know when this bond sell-off ends. Could it be around 3.0%? 4.0%? Could yields overshoot to the upside? The previously highlighted reasons driving yields are still present. That being said, once you have finished patting yourself on the back for having low duration or underweight bonds, this could prove to be an opportune time to start adding duration or simply adding to bonds for a few reasons beyond the fact that yields are much more attractive than they were a few short quarters ago. Sentiment, which is often a contrarian indicator, is very negative on bonds. The CFTC non-commercial combined positions have a strong bet calling for yields to keep rising (prices falling). Crowded trades can be dangerous if or when the tide turns. Which, of course, brings up the economy – it’s doing great. Labour gains are very strong but don’t forget labour is very lagging. In the coming months and quarters, economic growth is going to endure: the impact of sanctions, the high level of energy/commodity prices, and these higher yields. 30-year mortgage rates in the U.S. have risen from 3.2% at the start of the year to 4.5% today. Canadian mortgage rates are moving higher as well, both variable on the short end and longer-term off the 5year (we do mortgages differently than our American friends).

Investment Implications

Don’t get us wrong, we are not saying the ‘R’ word at this point. The economy has some solid momentum. But these headwinds will continue to put strong downward pressure on economic growth over the coming months, which takes time to show up in the economic data. Nor are we suggesting a 180-degree turn in bond allocations. However, if you are underweight bonds, heavily tilted to credit and short duration, it does appear an opportune time to start backing off that ‘right call’.

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used herein under a non-exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

Echelon Wealth Partners Ltd.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Ltd. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.