- Cycles

- Every cycle is both different and the same

- Is this cycle ending?

- Thoughts on the next cycle

- Last bull

- Next bull - Economy, inflation, and central banks

- Next bull - Yields & the cost of capital

- Next bull - Equities

- Portfolio construction implications for the next cycle

- Standard cycle playbook - Starting points matter

- Getting specific:

- Asset allocation – Wider IPS, flatter & more volatile returns – be tactical

- Simplify

- Equities - What is a balance sheet again?

- Value over growth

- Banks & Lenders

- Factor - Smaller

- Currency - Not the USD

- Geographic - Diversification is back to vogue

Executive Summary

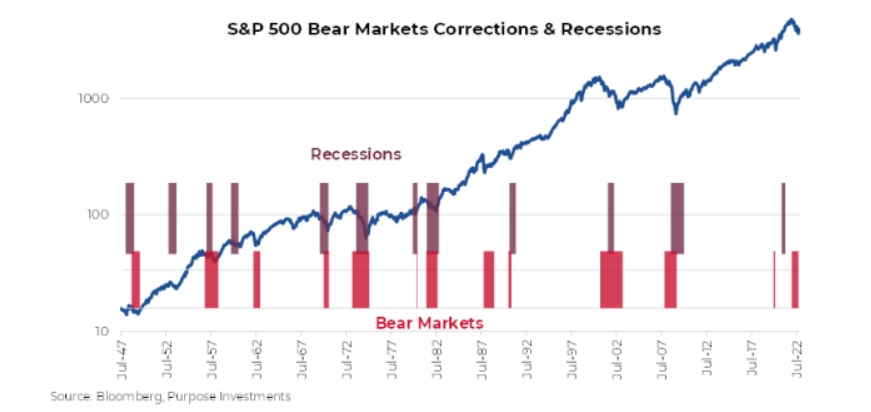

All good things come to an end, even bear markets. Of course, nobody knows when this bear market ends, we want to believe we are much closer to the end than the beginning, but this remains unknown. Some past bear markets have lasted a few months, some a few years. Maybe this one could end when inflation begins to improve, or it could end after the economic data worsens, or it could end when stock prices are so cheap that investors can’t resist. Or it will simply end, and many months afterwards, the ‘consensus’ will slap a reason or narrative why it ended when it did. Hell, maybe the bottom was mid-October – the markets have certainly managed to rally of late.

When this bear does end, it will birth the next bull cycle, which will not look much like the last bull cycle, given how much has changed. The last bull cycle, which was great and kind to investors, had a lot of help. Disinflation and low yields enabled central banks to stimulate whenever the economy or markets wobbled. Until near the end, geopolitical risks were low. Globalization trends remained strong, with steady gains in supply chain logistics encouraging outsourcing.

We would not dare say it will be different this time, but the list of changes in the economy, market, politics, and behaviours is significant. Looking at the last decade and the next – quantitative easing to quantitative tightening, globalization to isolationism, disinflation to inflation, office to hybrid, growth to value, large to small, monetary excess to fiscal excess, borrows to lenders, low yields to ‘normal’ yields…

All these changes will impact portfolio construction. Strategies that worked best in a low-yield disinflationary environment may not in the next bull if inflation and growth become more volatile. Some strategies that didn’t work well in the last bull may be better designed for the next. This isn’t a complete portfolio overhaul, but if you agree that the next cycle will be very different, some changes seem prudent.

The timing of those changes remains a challenge. We do not believe this bear market is over and many of the ideas and conclusions of this content are for the next bull. Unfortunately, nobody will know when the bear is over until well after the fact. We are probably closer to the bottom than the top, so gradually starting to position or line things up for the next bull does seem timely.

Preparing for the next bull - dives into cycles, why we think the last cycle is ending and thoughts on positioning for the next cycle. This introductory primer will see additions and updates as the markets wind their way through this bear and inevitably start the next bull.

II. Cycles

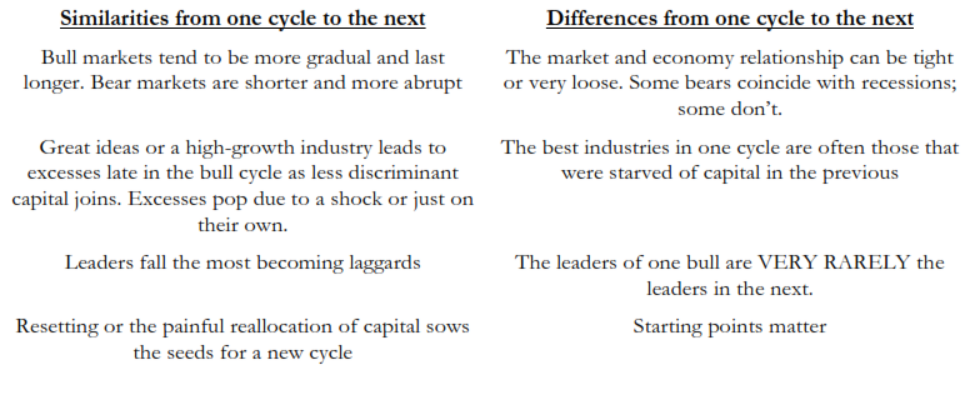

A. Every cycle is both different and the same

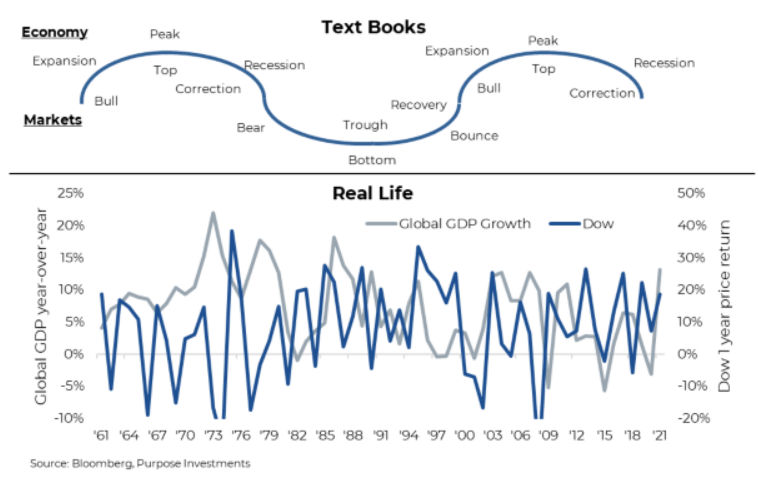

The economy moves in cycles, from expansion to peak to recession to trough to recovery and then back to expansion again. For anyone who remembers eco101 textbooks, the graphic was a nice wavy line representing these various stages that was both elegant and made the world seem so simple. Equity markets, too, pass from bull to top to correction to bear to bottom and then a bounce back into a bull. Unfortunately, the world is not that simple and rarely fits neatly into an academic construct. Different stages can last much longer than anyone expects or be much shorter. The economic growth line can be steeper, flatter, or erratic. During each stage, there are false turning points when it appears the path has changed, but it doesn’t. Then it does change, often surprising most. And this all masks the fact that each cycle has parts of the economy that are growing or contracting at various speeds, which tend to be different each cycle.

There is a lot of noise in the economy and the markets, but if you take a step back, there are very evident cycles. And there are clear turning points, which unfortunately only become visible well after the fact. Nonetheless, understanding which stage we are likely in and which is likely next has dramatic investment implications from asset allocation to portfolio construction.

It is human behaviour that causes both economic and market cycles. Good ideas become great ideas that attract more people or capital, and then it goes too far (we go too far). As the great idea collapses, depending on its size in the economy or market, it can also drag the rest down. Then we have a reset of expectations, and it starts all over again.

Since behaviours drive the economy and markets, this makes each cycle the same as previous cycles in some ways and different in others. Therefore, understanding what will likely be the same and what will likely be different is critical.

In every cycle, some things are the same, and some things are different.

B. Is this cycle ending?

Before we jump into what we think the next cycle will look like and discuss thoughts on portfolio construction implications, a critical question needs answering: is this cycle really ending? As we have highlighted, the turning points only become evident well after the fact; even then, there can be a debate.The pandemic bear of 2020 – This was a bear market in equities and a recession, which does check a lot of the boxes for the end of a cycle. And it could have been if not for the monetary response to backstop markets and then the fiscal response to backstop the economy. Without those responses, the shutdowns and changed behaviours would likely have led to a severe recession that would have ended the cycle that started in March of 2009. But the stimulus prolonged the cycle, leadership didn’t change, and previous areas of excess actually accelerated.

Today – Clearly, we have a bear market, but an accompanying recession is still to be seen. So why are we confident the 13-year-old cycle is ending? Well, leadership does appear to have already changed during the bear market, as the previous leaders are being taken out. Plus, areas of excess are really starting to reverse. This is evident in everything from profitless tech and venture capital to digital assets.

It is possible the uncorking of inflation, with the accompanying rise in yields, ended this cycle. The dynamics in the market have changed. And while inflation will come back down from these levels, it does not appear that we are heading back into a super low yield disinflationary environment anytime soon.

Besides, some sort of a recession or slowing of economic activity is clearly coming. Hopefully mild, but only time will tell. Nonetheless, we think this will be enough to wash out many past excesses and start a new cycle…once the bear is over.

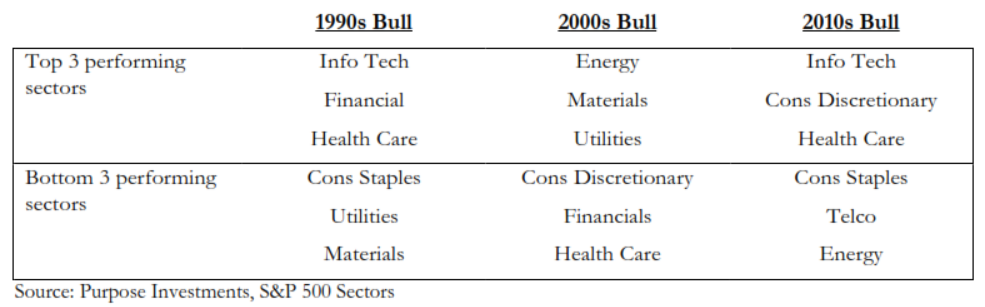

II. Thoughts on the next cycle

So how will the next bear cycle look? There are many unknowns, including what it looks like in the early and later stages. But we do know every bull market cycle DOES NOT look like the previous bull. So with this mindset, let’s start by looking at the last bull, so we know with some confidence what the next bull ain’t.A. Last Bull

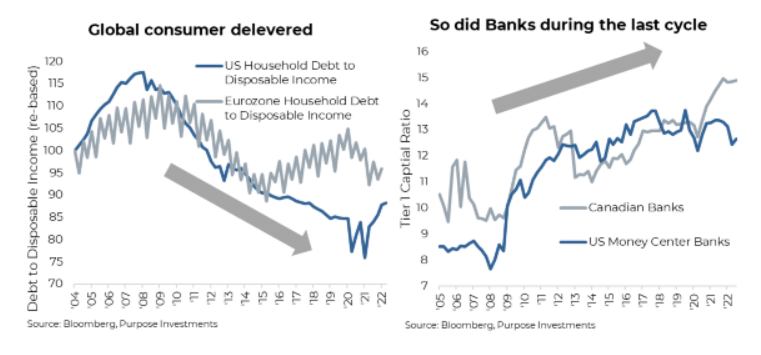

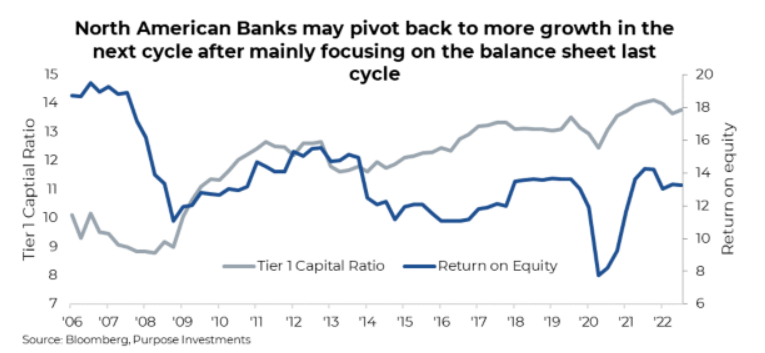

It was born out of a credit-driven recession (GFC in 2008/09). Credit-driven recessions historically lead to deleveraging, which was evident at the consumer level, more so at financial institutions. Perhaps less so for the Canadian consumer but the big ones, namely U.S. and European consumers, have significantly lowered debt to disposable income during the past bull cycle.Banks too. During the 00s bull cycle for banks, it was all about earnings growth and return on equity. After the GFC and during the 10s bull cycle, all investors wanted to hear about was safer balance sheets. And they sure did deliver, backing away from many business lines to hold less leverage on the bank balance sheet. This opened the door for alternative lenders to fill part of the gap, more on that later.

B. Next bull – Thoughts on the economy, inflation, and central banks

While we remain unconvinced the next bull market has started, it will begin at some point. So how do we think it may look? There are a number of good aspects for the next cycle and some more challenging. We believe nominal global economic growth, which had been suppressed for much of the last cycle due to deleveraging, is likely to return to a healthier pace in aggregate.

This growth will not be smooth, either over time or across regions. The last cycle’s economic growth was low but relatively stable, given that central banks could intervene without any inflation repercussions. That is clearly not the case anymore, which will lead to greater variability of economic growth. Expect larger economic swings and faster, shorter cycles. Economic growth will also be less synchronized across economies. While we do not believe the trend in global trade is reversing, the map is being redrawn somewhat. Following the pandemic and war, diversifying supply chains of many inputs and, notably, energy will likely remain a gradual trend. The cost will remain the dominant driver in decisions (it always is) but no longer the only driver of supply chain structures. All are contributing to more variance across economies relative to before.

It was the lack of inflation that was the problem during the past cycle, up until near the end. Remember those charts of all the negative-yielding debt, which peaked at $18 trillion globally? Today, the tally is less than $2 trillion, and those bonds are just in a couple of countries now. Or recall when deflation was the big fear? That has certainly changed today.

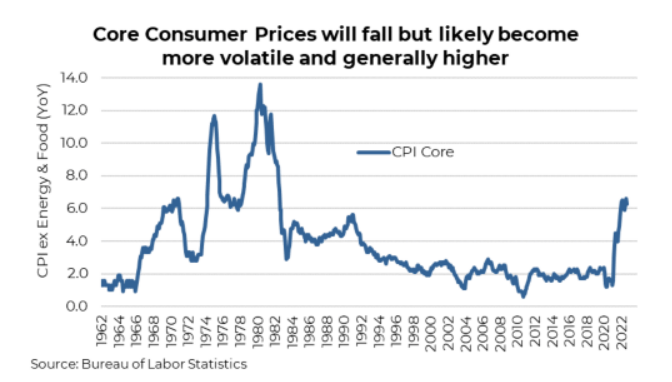

Inflation won’t remain at the current high single-digit pace (or low double digits in some countries) and may have already started to come back down from pandemic imbalances. It may even come down faster than many expect as goods inflation turns disinflationary and the economy slows. But the next cycle will see higher average inflation, and it will likely be more volatile, similar to economic growth.

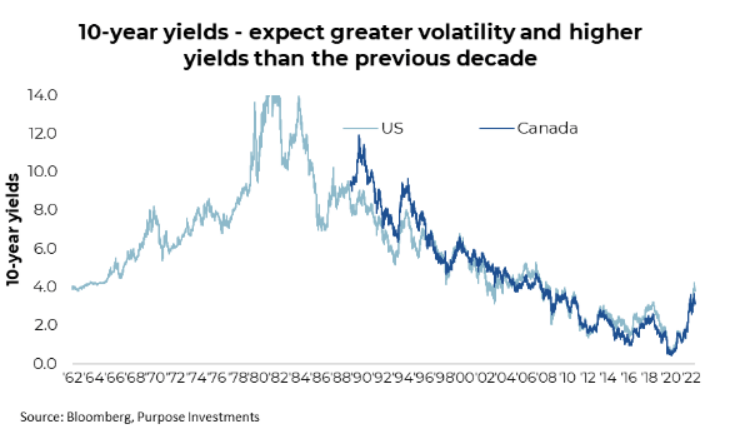

Higher average inflation begets higher yields in the coming cycle compared with the last. And it will limit the freedom central bankers have enjoyed in implementing policy. The punch bowl isn’t gone, but the days of ‘all you can drink’ are over. Policy response to a slowing economy will depend on the inflation at that time.

This brings up the issue of tenors. Markets, the economy, and inflation all have different tenors. The market, given daily pricing, is pretty fast – news or changes are reflected quickly. Sometimes wrong, but certainly fast. Parts of the economy, while slower than the market, react slower to changes. For instance, housing sales activity does react pretty quickly to changes in interest rates or employment. Home pricing reacts as well but slower, and construction even slower. Overall, employment is a slow or lagging measure, given companies will hold on to people, even if business is slowing, until they can’t. Inflation and overall pricing is even slower.

Due to these different tenors, countries will likely see periods when economic growth is improving and slowing, combined with inflation that is either rising or falling. Depending on which combination, there will be periods when central banks can implement support policy and periods when their hands are tied. This will lead to larger swings in the economy and likely markets.

C. Next bull – Yields and the cost of capital

The cost of capital during the past cycle was abnormally low (yields), mainly due to deleveraging triggering disinflation pressures. Whether you attribute this to deleveraging or central bank quantitative interventions, it doesn’t really matter because that is over (or will be greatly reduced). This will raise the cost of capital which is a headwind for growth. However, those low yields led to misallocations of capital into less or non- economic endeavors.

In the last cycle, capital was plentiful and cheap. If you had a heartbeat, you could raise money in the debt market. This encouraged leverage, opened the door wide for earnings engineering (issue bonds, buyback stock), and fueled growth through acquisition, etc. These are unlikely to be strategies that work nearly as well in the next cycle compared with the past.

The low cost of capital also meant that simply owning assets in the last cycle worked really well. Going forward, not so much, and it will be operating companies that are growing that should be able to manage the higher costs and inflation swings.

D. Next bull – Equities

Equity investors have had little to complain about over the past decade, apart from the current bear market, of course. Even with this pullback, global equities have annualized a little over 8%, clearly delivering. This is a bit below the VERY long-term annualized pace of 9.7% (back to 1950), decent nonetheless, given the endpoint is in a bear market phase.

We do continue to believe equities will do well in the next bull cycle. Literally, that is what defines a bull cycle. However, the drivers of performance may be materially different, which is worth considering.

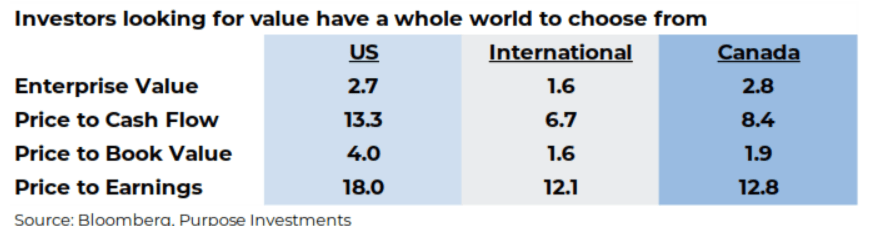

Valuation tailwind may prove challenging – There was a lot of multiple expansion during the past cycle, which was mostly given back during the bear phase. That is pretty normal. The U.S. is still slightly elevated, while global equity markets – including Canada – are cheap. We do not know the starting valuation point for the next cycle as we don’t believe it has begun. In the next cycle, if inflation remains a recurring issue/flareup and bond yields average out at a higher level compared with the last cycle, valuation expansion will likely be somewhat muted. There is a strong historical relationship between bond yields and the valuation multiple in the equity markets.

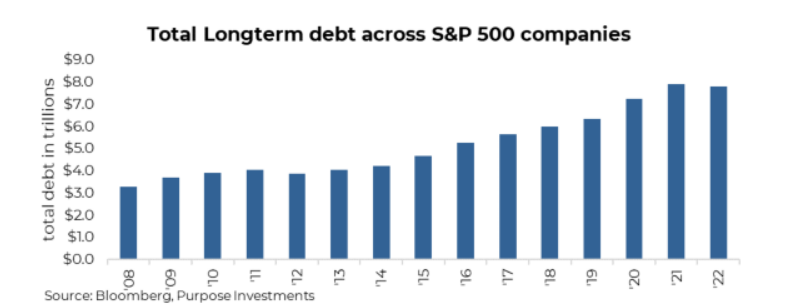

A potential headwind is the cost of capital. The last cycle was filled with companies enjoying falling interest expenses thanks to lower yields, even with the level of indebtedness rising. This tailwind to earnings is likely over and may become a headwind in the next cycle. Plus, how many companies issued debt to buy back shares to enhance earnings per share growth? Well, that is over. A report from BNP estimated 20% of earnings growth for Europe in the last decade came from the above combination. Likely similar in other jurisdictions, earnings growth can’t be manufactured as it was in the last cycle. Companies have to grow their business more to see earnings growth.

Overall, we would expect earnings growth to be somewhat lower than the last cycle. Combine that with potentially less valuation expansion, and the next cycle may be a tougher slog for equities. But equities are not homogeneous, and we believe a greater focus on the balance sheet, growth strategy, and impact of variable inflation (labour intensity, ability to raise prices) will be essential.

The last cycle really benefited the growth factor and mega-caps, a combination that really favoured passive beta-heavy market exposure. Given the changing dynamics, this is unlikely to repeat. The next cycle will more likely favour tilts more towards the value/dividend factor (less duration) and less of a mega-cap bias.

III. Portfolio construction implication for the next cycle

We do not believe that the bear market is over or that the bottom is in yet. But we do believe this is a cycle- ending bear market given inflation, central banks, speculative excesses being removed, and slowing economic growth. And at some point, a new bull cycle will begin. In this section, we narrow our views down from the macro cycle thoughts to potential portfolio construction considerations for this new cycle.

A. Standard cycle playbook – Starting points matter

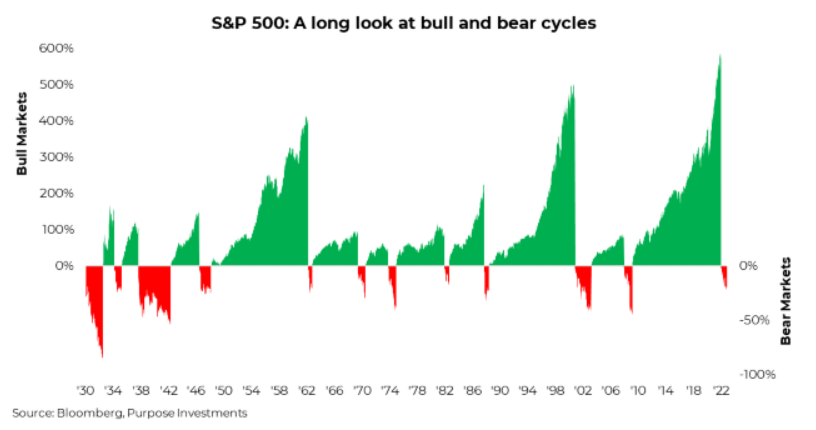

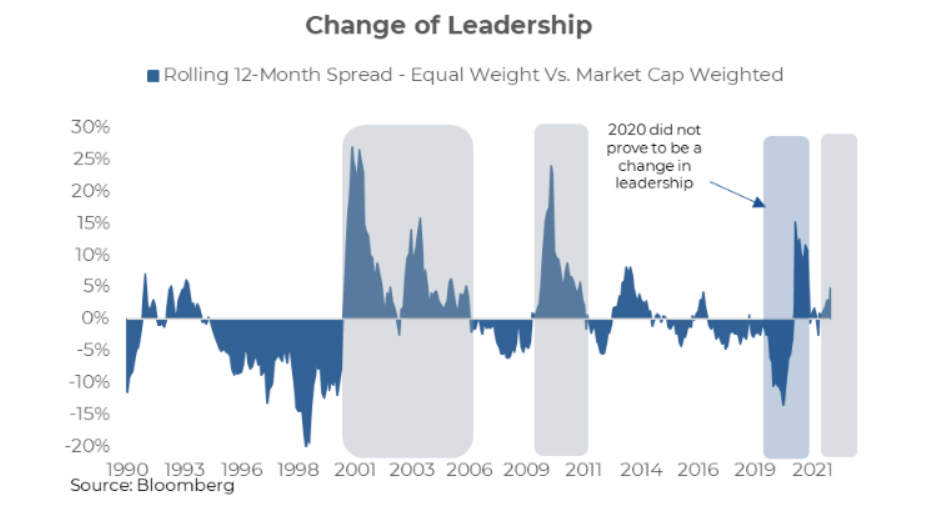

There are some standard cycle characteristics that are worth considering. On average, equities enjoy some of their stronger returns in the early stage of the bull and the very late stage. The initial recovery is often predicated on hope more than anything else, and the fundamentals catch up later. Leadership often changes, with the new leaders not becoming apparent until well into the cycle. At first, all we know is the previous leaders are at risk. This can be a headwind for cap-weighted indices depending on how concentrated the index has become in previous winners.

Bonds may not follow their normal playbook. Typically, bonds are bid up in a bear as a risk-off destination for capital and give up some of those gains as the new bull cycle begins. Given this was an inflation-induced bear market, moving yields higher, pretty sure nobody has been running to bonds as a safe haven risk-off move so far this cycle. That may change if economic growth slows more than most are expecting.

Usually, there is a recession associated with a bear market. Historically (the 40s-80s), the recession has taken hold before the bear sets in, but in more recent decades (90s+), the market has started to be the early mover. Maybe better economists’ forecasts? Or, given the consumers increased wealth exposure to markets over time, maybe the wealth effect of the bear market now causes the recession. Sorry, I’m falling down a rabbit hole here. The crux is there will likely be some sort of recession ahead. Maybe not in every country, and maybe it has already started in Europe. While markets now tend to fall ahead of recessions, they have also bottomed well before the economic pain intensifies. This is good news, considering the economy in North America is not near a recession yet.

Bond yields are not high by longer-term historical standards, but they are very healthy. This does appear to be an attractive starting point for bond yields going into the next cycle. Of course, lots could happen in the near term, but the risk/return balance is decent.

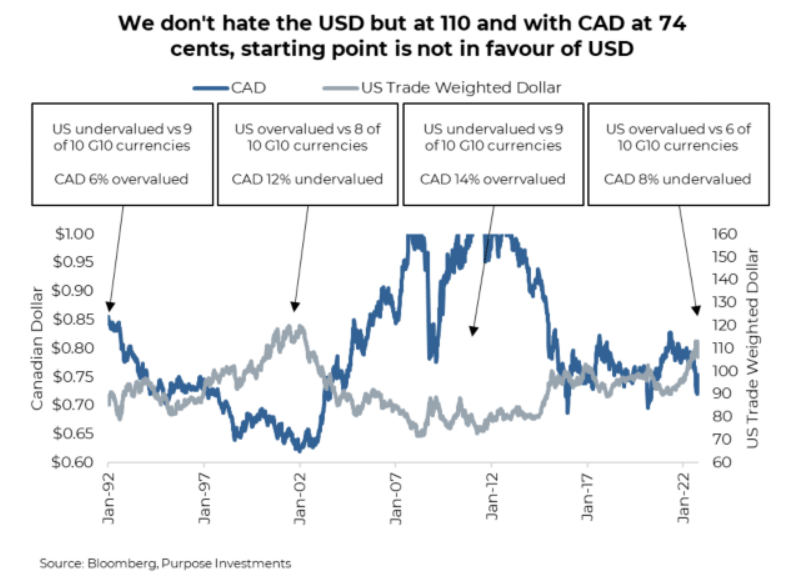

The starting point for currencies favors the Loonie, or more accurately, disfavors the U.S. dollar (USD). Developed market currencies are often a zero-sum game in the VERY LONG TERM. If one country’s currency becomes too overvalued, they become less competitive, their assets cost too much, and money flows out. If a currency becomes too weak, say the pound or yen, at the moment, the opposite happens. The economy becomes more competitive on the global stage, and opportunistic buyers come in. Anecdotally, Americans have been increasingly active in buying U.K. real estate of late and friends in Japan have never been able to get such quality sushi for a reasonable price (converting back to USD, of course).

The U.S. dollar may not be extremely overvalued, but it is up there. And the CAD may not be bargain- basement, but it is on the ground floor. The chart below highlights how the U.S. dollar stacks up against other G10 currencies and vs CAD based on purchasing power at the start of all past bull cycles.

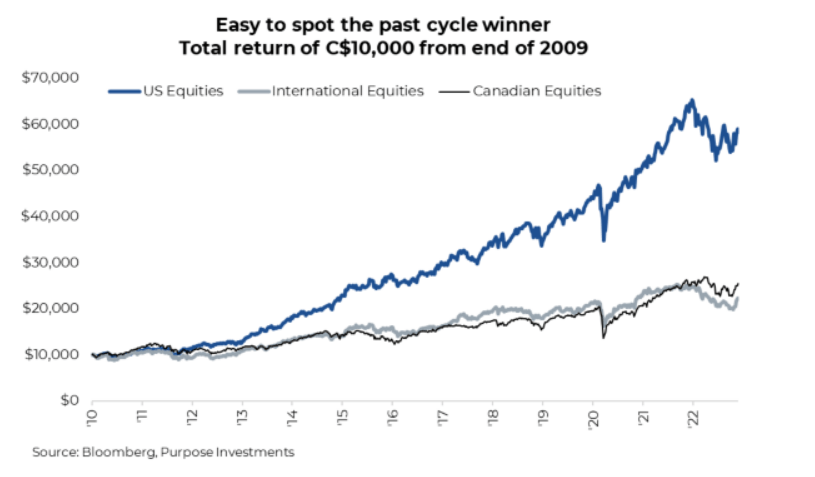

What has worked for a decade that may not work anymore - In the long run, when talking full cycles, many things revert back to the mean or average. If we are close to the start of the next bull and based on relative returns in the last cycle, this does have many portfolio construction implications. The CAD or international currencies relative to the USD, Canadian and international equities relative to the U.S. market that was the darling last cycle. Value over growth, small over large-cap, the list goes on.

i. Asset Allocation – Wider IPS, flatter & more volatile returns – be tactical

What should you do if you could hop in a time machine for your portfolio and go back to the start of the last bull cycle in 2009? The answer is simple: screw asset allocation, including bonds and alternatives, pass on all the fancy investment strategies, embrace the full volatility of the market, and simply buy equities – ideally U.S. equities in the form of the S&P 500. Then turn off your monitor or access to updates/quotes, set it and forget it for a decade or so. Or if you really wanted to trade, BUY THE DIP . Anytime the market weakened, buy some more.

Unfortunately, time machines don’t exist, and you can build a portfolio based on 20/20 hindsight anytime. And this looking-back investment approach arguably does the most damage to investor portfolios. So, without the benefit of hindsight, what led to this nice upward and relatively smooth ride starting at the end of 2009?

Starting point – The global financial crisis-induced bear market in 2008/09 was not fun, but it did effectuate a complete reset of valuations and decimated investor expectations about the future. That is a good setup for healthy returns going forward.

Yields – The resulting deleveraging of the global consumer and global banking system created a disinflationary environment. This caused lower-than-normal economic growth (bad) but continued to put downward pressure on yields (good). Low yields became one of the engines for equities, whether in financial engineering or simply because there was no alternative to equities.

Fed put – In a disinflationary environment, central banks can do as they please as their actions won’t result in imbalances as easily or inflation. This disinflationary cover enabled central banks to really expand their playbook and come to the rescue anytime the market or economy faltered. Aka, the Fed put – if the market drops 10%, the Fed or other central banks will jump in with more stimulus.

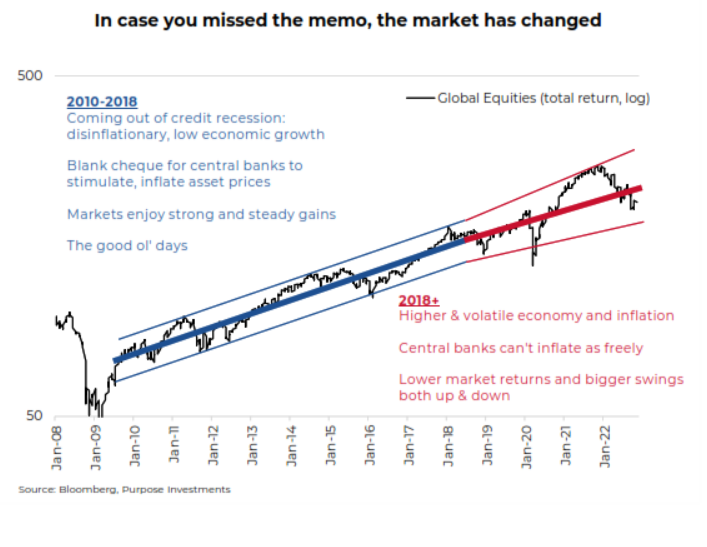

Added up, and markets enjoy strong returns with limited volatility – a pleasant world denoted in the blue section below.

In fact, on anyone’s Bloomberg, you can call up a list of some of the most popular technical trading strategies and see how they all faired over a certain period. These include things like Bollinger Bands, Relative Strength, MACD, Moving Average strategies, Rate of Change, and the list goes on, totalling a little over 20. From the end of 2009 until mid-2018 for the S&P 500, the dominant strategy was buy-and-hold. And when we say dominant, it destroyed all other strategies from a profitability perspective.

But this market does appear to have changed in mid-2018, and if not, things have certainly changed in 2022. We are currently in a bear market which does add a lot to the swings in the market (bear = much more down, clearly). And it is common for the market gyrations to become very high late in a bull cycle, as was the case in mid-2018 onwards.

Big market swings are much less friendly for a buy-and-hold approach and for those faithful ‘buy the dip’ folks. During the bull, investors that did some buying whenever the market dropped 7% or more did well. Investors who bought the market when it went down 7% in 2020, or 7% in 2022, did not do well. T he market dynamics appear to have changed.

We would certainly not view the last year or even back to 2020 as normal. The question is when the bear market ends and the next bull begins, what kind of bull market will it be? We could hope for another bull cycle with really healthy returns and low, smooth volatility, but that is probably not the case. The disinflationary cover of the last cycle is clearly gone. This will likely lead to higher and more volatile inflation and the same for economic growth.

Reflexive markets – In this less controlled market environment, the regression to the mean may give way to a more reflexive market. Whether you prefer George Soro’s reflexivity or synonyms for reflexive, including spontaneous, unintentional or uncontrolled, the implications are the same. A market that feeds upon itself, resulting in bigger swings both up and down. Weakness begets more weakness; strength begets more strength.

Add to these bigger swings potentially a market with a flatter or lower return trajectory. If inflation and yields remain higher than the last cycle, multiple expansions will be harder to come by. Plus, a chunk of earnings growth last cycle was driven by share buybacks fueled by issuing low-cost debt. Companies are going to have to grow the old fashion way in the coming cycle.

This market may have already changed. From mid-2018 until now, many different momentum-based trading strategies have outperformed the static buy-and-hold. And this is during a period that the market has annualized over 10% returns. It does appear something has changed.

Portfolio considerations - If you agree that equity returns will be marginally flatter in the next cycle and there will be increased gyrations, both up and down, this does have portfolio construction considerations, namely being more tactical.

- Wider IPS limits – From an Investment Policy Statement perspective, you may want greater latitude within each asset class. If (when) equities go on a strong bull run, you may want to allow it to run further before rebalancing. And vice versa on a downswing.

- Momentum – in this kind of environment, momentum as a factor should perform better. The bigger swings help, as does the flatter general return trajectory, as this reduces the lost performance when out of the market.

ii. Simplify

This bear market may not be over yet, and yields could tick higher, equities lower, earnings could fall, and maybe even a recession. But already, there has been a massive reset of valuations and expectations. The speculative fever that was evident late in the last cycle is clearly gone, just ask any venture capitalist trying to raise money. Today, you can buy the TSX with a dividend yield of 3.1% and trading at a valuation of 12.4x. The Canadian bond universe now yields 4.1%, while the corporate subset yields 5.3%. The majority of bonds now trade below par, and cash has a decent return.

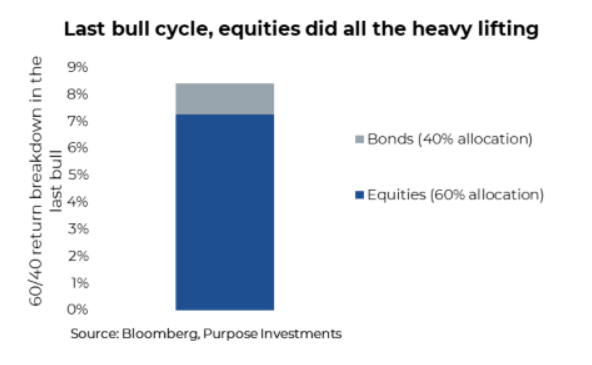

We are not contending that any of these measures are cheap; that will depend on their valuation or yield a few years down the road. But we can say after the painful reset in the first half of 2022, when everything simply fell in value, the market is much more balanced or fair today. This should better balance out returns in the next cycle. There is no denying returns in the last bull came mainly from the equity side of the portfolio. The following chart is the return attribution for a 60/40 portfolio from the end of 2009 to the end of 2021 (before this bear). With total performance a little over 8% annualized, almost all the performance came from equities.

As we near the start of the next bull, it would appear that yield is now plentiful. Available in equities, bonds and cash. Given the biggest contributor to bonds, returns are the yield at the time of purchase, and these higher bond yields should better balance the performance contribution for portfolios. This bond & equity bear of 2022 may have actually reset returns in favour of the old boring 60/40. It’s been a painful journey to get here, but it’s a much more balanced investment landscape.

Today with yield now being abundant, does your portfolio need to be as creative? Many of the strategies developed and used today carry other risks, perhaps geographic or execution or some nuanced risk that few investors are aware. They may still have a place in a portfolio, but with plain vanilla yield now readily available, simplifying a portfolio’s yield component may prove prudent.

iii. Equities – What’s a balance sheet again?

In a world where anyone with a heartbeat can issue a bond with light covenants and a low coupon, it’s not surprising companies jumped on this attractive source of capital. Tap the bond market for money, go buy a competitor, integrate the business lines, pay down some of the debt, rinse and repeat. Or just use the bond proceeds to buy back stock, engineering some added earnings per share growth. In a low yield/rate environment with tons of capital available, neither are surprising strategies. S&P 500 constituents now carry about $8 trillion in long-term debt. But corporate strategies will have to adjust as the debt market becomes less borrower-friendly, with stronger covenants and higher costs.

Supply chains are being at least partially reformed. The desire for greater diversification in the supply of inputs is a trend that is slowly building. Companies are already starting to invest in more supply closer to home, even if the expense is higher.

Next cycle equity leadership – We don’t know who will lead in the next cycle from an equity performance perspective, wish we did. But a disinflationary, low, stable economic growth with consistent central bank stimulus seems very unlikely. The winners in the next cycle may be those companies that either benefit from the changing landscape or can best manage it. At the equity level, we believe investors should place increased emphasis on:

- Balance sheet – The amount, term, fixed or variable are all becoming more important going forward. We are already starting to see this factor come up more often, and remember, the economy has barely slowed. If we have more volatile inflation and economic growth, leverage does become more dangerous.

- Output and input inflation – Cost inflation, from such things as higher wages, debt service costs or diversifying supply to a high-cost source, is not an issue as long as the company can pass on those costs. It is the relative mix of output and input inflation that separates the winners and losers. And this mix will determine whose margins stay healthy or get crushed.

- Adapters – If labour costs do become an issue, which companies are providing solutions to increase productivity to offset the cost? If companies decide to bring production closer to home, which companies benefit or enable that activity? Business intelligence has made large advances over the past decade, and companies are leveraging this potential advantage to increase productivity.

We don’t think the next cycle will be a set-it-and-forget-it bull run. The diversity of returns will likely be greater, and it won’t necessarily be the mega-caps of today that win. Dare we suggest fundamental analysis may be coming back into vogue?

iv. Value over growth

For the past decade, Investors have been dancing on the grave of value stocks, wondering when a shift over to value stocks may occur. Amidst a low inflationary environment, growth was certainly the winner. If you managed a Canadian Equity portfolio that didn’t own Shopify, you likely underperformed the market on the upside or outperformed on the downside. In the U.S., if you didn’t own a ton of Amazon and Microsoft, you couldn’t keep up. The tide has certainly turned during this bear market, with value outperforming growth by 23% (S&P 500 Value vs Growth Indices).

This reversal in favor of value is really driven by how much growth led in the last bull and how extended it became. In a cycle-ending bear market, the previous leaders tend to suffer the most. So, when the next bull begins, will it be value or growth? We believe value will be the stronger performing facto in the next bull for a few reasons:

Shorter duration – given our view that economic growth will be higher and more variable this coming cycle, value should do better. Higher economic growth tends to be better for value as the companies are more economically sensitive. Plus, growth benefited from stable and falling yields based on their longer duration earnings stream. Since we believe that will change, shorter duration value stocks should far better.

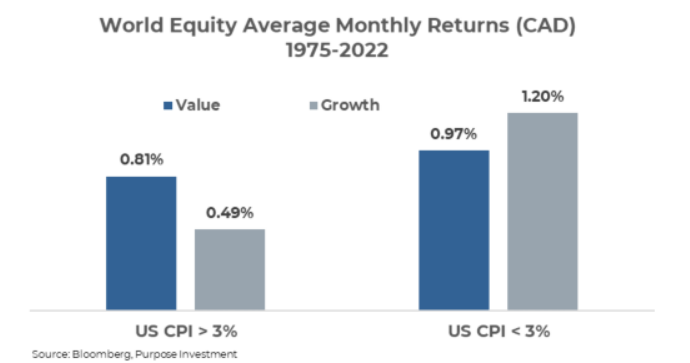

Higher inflation – While the current inflation level will come back down, our view is that it will continue to flare up and remain more volatile and average at a higher level than the last cycle. This is better for the value factor. Looking back over the last 47 years, there was approximately the same number of months where inflation was greater than 3% as there was inflation below 3% (US CPI). Separating those two periods, value stocks outperformed on an average monthly basis by +32 bps in periods where inflation was greater than 3%. As you can expect, in periods where inflation was less than 3%, growth beat value by approximately +23 bps. Low inflation and quantitative easing throughout the prior decade brought returns out of growth equities that investors grew comfortable with, an asset class upon which could be relied. However, what is familiar and comfortable is not likely what will transpire in the next cycle.

For the same reasons we like value in the next cycle, this does translate to dividend investing. During periods of volatile economic growth and higher inflation, dividends play a role in reducing the volatility of a portfolio. And while bonds have certainly become a stronger competing asset class given the rise in yields, if inflation does remain elevated in the coming cycle, equities have a better chance of navigating that kind of environment – especially those with some pricing power and not over-indebted.

Among dividend payers, keep an eye on leverage. Companies with higher debt are unlikely to raise their dividends in a higher-rate environment. Paying down debt will become a higher priority for these companies, which can present a long-term challenge. If inflation protection is not what you seek, keep in mind the simple fact that these companies paying a dividend means that they have free cash flow and are profitable, resulting in less standard and downside deviation in volatile times.

Moving forward through the next cycle, having a portfolio tilted towards value with a focus on lower-leverage dividends may contribute to outperformance in portfolios. A focus on shorter-duration equities with less leverage will help portfolios in an environment of higher rates and inflation. Even with the outperformance of value over the last couple of years, the price reset provides an opportunity to allocate to value as they are very much discounted to their growth counterparts.

v. Banks and lenders

Banks in Canada and even more so globally have so many various divisions and moving parts in their business it is very challenging to group them together. A little easier in Canada, but even among our big six, some have more or less real estate exposure, C&I loans, FICC, investment banking, wealth and international operations. We could devote many more pages to the topic. However, there are some general long-term trends that should be positive for banks in the next bull cycle.

In the early 2000s, if you listened to a bank’s quarterly conference call, you would have heard a lot about return on equity, growth, and maybe acquisitions. After the 2008/09 financial crisis bear market, the messaging certainly changed during those calls. It was then all about the balance sheet, how much tier 1 capital, tighter on lending, and less risk. Beyond investor demands for this change, two things contributed to the pivot: 1) the near-death experience for some banks during the financial crisis and 2) lending simply became less profitable.

The next bull cycle will likely be different. For one, capital will be less abundant and cost more (remember, cost is revenue for the lender). The quest for yield, when yields were low, provided a near-endless amount of capital for any lender that could pay back just a little more to investors. But now, cash yields a decent amount, and government bonds yield much more, as do many traditional sources of yield. The quest for yield may be quenched as yield is everywhere now.

Less abundant capital and higher cost of credit has the advantage passing from the borrower to the lender. And the lenders in the best position are those with a diversified basket of deposits or capital. Banks have many sources of capital, but many other lenders do not. We believe banks may retake market share in the next cycle, helping their profitability.

BUT, there is likely no rush as there is a near-term speed bump for banks in the form of a potential recession/slowdown and/or housing risk. Yes, there is a current lift from things such as net interest margin, with the uncertainty of loan loss provisions. After the bump, we believe banks could be a strong performer for the next cycle.

vi. Factor – Smaller/equal weight

The S&P 500 remains very overweight, the winners from the last cycle. This will likely prove to be a headwind during the bear and into the next bull if leadership is changing. What works in the previous decade is likely not what will work in the next decade. A change of leadership is very common when the cycle shifts. The companies that outperformed in the 2010s (Mega–Cap) have already shown signs of underperformance, dragging the market-weighted indexes down along with them. This has opened the door for equal-weight indexes to outperform.

Looking back over the last 30 years, the best times to shift the portfolio to equal weight have been at the end of a cycle. The challenging part is determining, of course, when that actually is. We are not proponents of market timing; however, in the argument of equal weight vs. market weight, there are benefits to timing the allocation change. Over the long term, since 1990, it really does not matter whether or not you were equal , or market-cap weighted. The S&P 500 equal weight returned an annualized percent of 9.7%, while the market- weighted counterpart returned 9.9%. Not much of a difference, but within that long-term chart, there are a few pockets where equal weight outperformed.

In the Dot-Com bubble of 2000, equal weight massively outperformed due to the concentration of the index in Technology. The market shifted and discovered new leaders as energy, materials, and utilities became the top-performing sectors of the index. The timing to shift to equal weight in this scenario was at the peak of the bull, but adding equal weight throughout the correction would have served just as well. There was not as much of a concentration risk correction in 2008 as it was in 2000. However, coming out of the bottom in 2008, we still witnessed outperformance of equal weight until 2011. So that leads us to today and the years ahead. We have already seen outperformance of equal weight off the peak at the beginning of 2022.

Small-cap – Keeping with the same thought of not knowing who the winners of the next cycle will be, tilting towards small-cap for the early period of the bull cycle historically has proven more profitable for portfolios. There appear to be more potential tailwinds for small-caps than headwinds whenever this next bull market begins. But the timing is very impactful.

Big drops & big pops – One of the reasons small-cap tends to outperform early in a bull cycle is it often does so terribly during the bear. This has not yet been the case for this bear, as inflation has driven it. If a recession develops, small-cap will likely suffer more, so timing any small-cap tilt is challenging at this point.

Concentration – Similar to the equal weight thesis, if you don’t know who the next leaders will be, simply less exposure to previous leaders is the best strategy. Given it was mega-caps that led, by definition, those companies are not in the small-cap world.

Inflation – There is a history of small-cap outperforming as inflation begins to come back down. Looking back at periods of inflation in the 1980s and 1990s, there have been two periods where inflation spiked higher than 6% and subsequently came back down. During these two periods of slowing inflation, the U.S. small-cap outperformed the large-cap by a significant margin.

We do not have enough data yet to determine where we are at in the current inflation cycle specifically. However, we have seen inflation come off slightly from its peak a few months ago, and in that time, the Russell 2000 has outperformed the S&P 500. We caution again: this is a very small sample size. Now the easy part, determine if that was the final peak inflation reading or if we still have more to go.

Currently, we are most comfortable with our equal weight call and, let’s say, slowly warming up to small-cap. When we have more confidence, the bottom is in and a new cycle has begun, we expect to become stronger fans of small-cap.

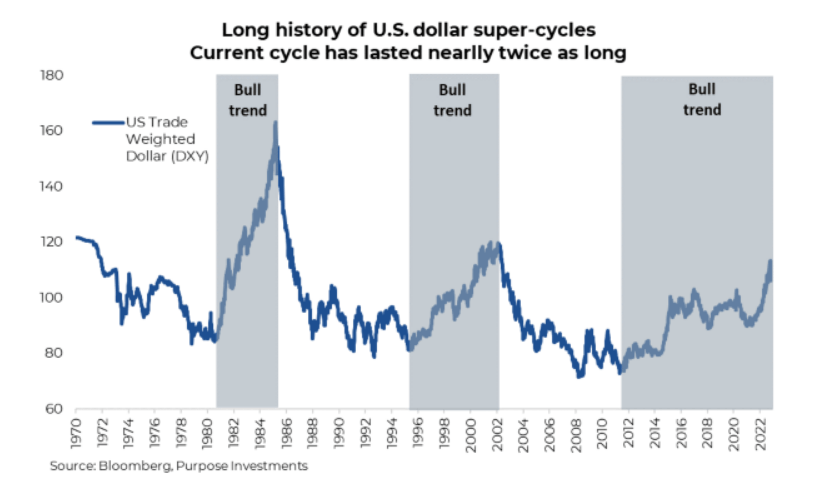

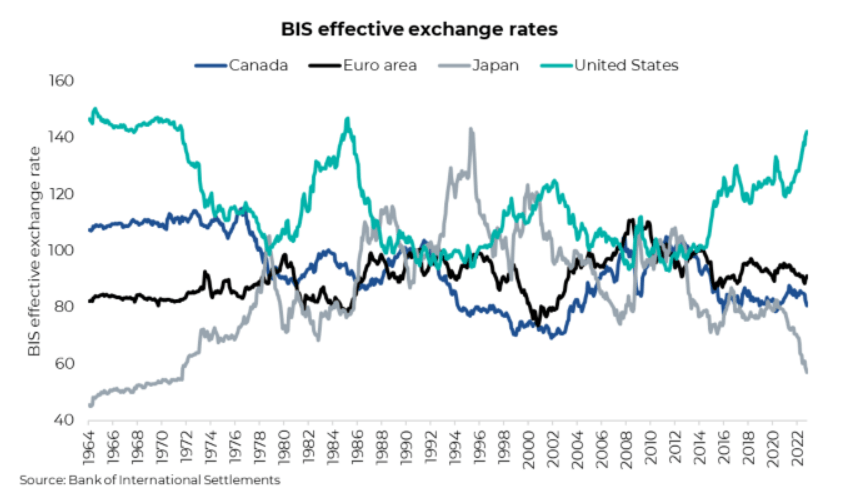

vii. Currency – Not the USD

Being on the right side of long-term cycles in currency markets can be very profitable. Like any other market, foreign exchange markets have their own unique cycles, of which super cycles can last for extended periods of time. The last two super-cycles averaged around six years; however, the current cycle is now in its eleventh year – quite the run. The broad-based U.S. dollar Index (DXY) bottomed in 2008, consolidated for a few years, and has risen 57% since 2011. It went through several smaller cycles but consistently made higher highs and higher lows – the definition of a strong, trending market.

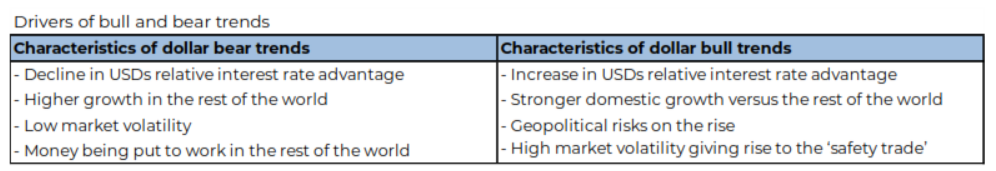

The shift is on – After a strong rise this year, we have our doubts that the current currency cycle will endure through the next bull market. The current bull trend in the U.S. dollar has gone on far longer than previous cycles, though it’s simplistic to state that we’re overdue. In the framework below, we’ve tried to simplify the conditions that merit cyclical bull and bear trends for the U.S. dollar. Over the past few years especially, nearly all of the dollar bull conditions have been met; however, looking ahead into the next bull market, this will not always be the case.

The speed and ultimate extent of a U.S. dollar decline will depend on many factors, including how quickly inflation falls, if the U.S. enters a recession, how fast global economies recover, as well as evolving policy from central banks. We’re still in a bear market, and the U.S. dollar is behaving as it usually does: a solid safe- haven asset. However, with the current conditions, it looks increasingly likely that the U.S. dollar is beginning a peaking process. Ultimately the U.S. dollar will remain strong so long as there remains lots of uncertainty and a strong carry trade. This won’t change overnight and centers on inflation cooling and a return of a healthy risk appetite.

viii. Geographic – Diversification is back in vogue

It isn’t this simple, but it just might be. In the ‘80s, the U.S. sucked, as did the U.S. dollar (USD); meanwhile, international markets rocked. In the ‘90s, the U.S. rocked, as did the USD, while all other markets trailed. In the aughts, the U.S. lagged, plus a weak USD, while TSX and emerging markets (E.M.) crushed it. In the most recent bull, the ‘10s, the U.S. was the star again, plus a strong USD, while others lagged. If this simple long- term pattern follows, the ‘20s should be international/E.M. with weak U.S. and USD.

Geographic diversification has always been a core tenant of portfolio construction. Unfortunately, it’s been more like geographic ‘diversification’ over the past cycle. A simple overweight U.S. equity has been the no- brainer portfolio allocation moves, as seen in the chart below. U.S. mega-cap tech has been the global cycle leader driving U.S. returns over the past cycle to outperform Canadian and international allocations significantly.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

— Brett Gustafson is a Portfolio Analyst at Purpose Investments

— Derek Benedet is a Portfolio Manager at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only. This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.