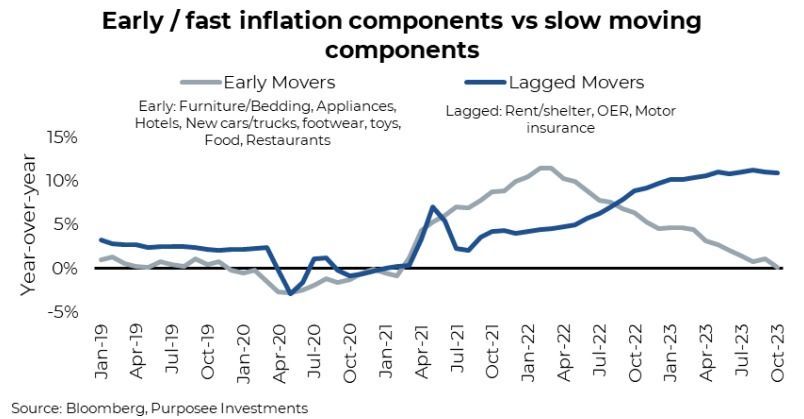

Among all the components of the CPI index, some react to changes more quickly than others. The faster moving parts are coming down quickly and are now flat on the year (chart). The slower components are still high but also appear to be starting to roll over.

Cooler inflation data and cooler economic data have helped bond yields come down. Measuring the 10-year Treasury, yields dropped from 5.0% at the S&P 500 low near the end of October to 4.46% at the time of writing. So does a 50bps yield drop equate to a 9% or near 400-point rise in the S&P 500? The lower yield does open the door to some multiple expansion. The market weakness in October was primarily caused by high yields. If 50bps = 9%, well load up. We think yields will continue to grind lower on softer economic data. Unfortunately, that “math” won’t hold. There has been something else afoot in the month of November… stimulus.

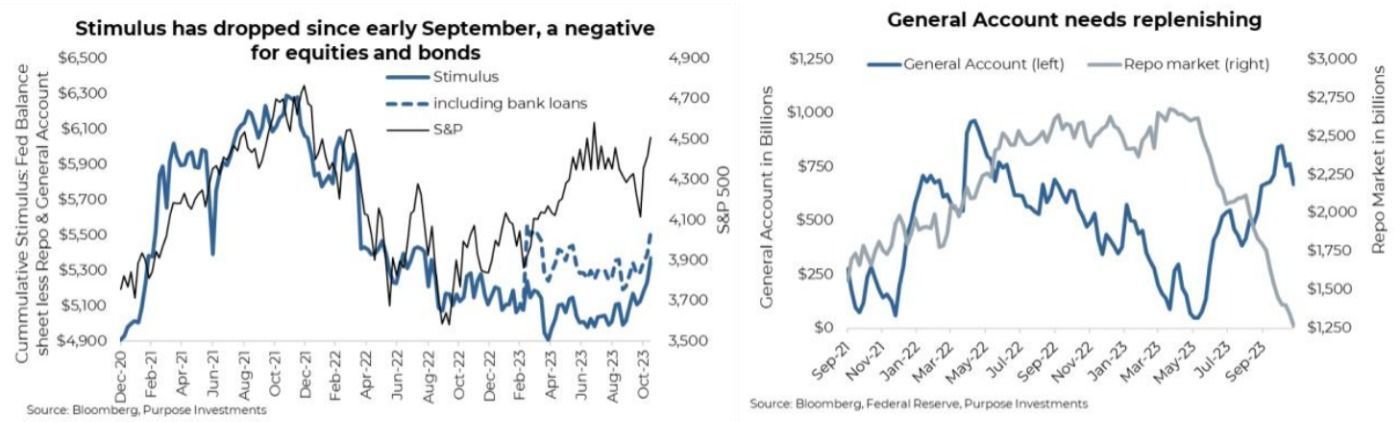

In a simpler world, higher overnight Fed funds rates plus gradual selling of bonds at about $50 billion per month from the central bank’s $7 trillion hoard would equate to tightening financial conditions. Or Quantitative Tightening (QT), the opposite of Quantitative Easing (QE). But just like inflation, Q (E or T) doesn’t move in a straight line. The Fed’s balance sheet has continued to grind lower, but the general account and Repo market (Reserve Repurchase Agreements) have not. In June, with the debt ceiling kicked down the road a bit, government bond issuance jumped higher to replenish the general account (the government's chequing account). This would add to tightening, sucking money out of the financial system. But, the Repo market simultaneously started to move lower. Think of the Repo market as a place where money ended up when there was too much money sloshing about, and it has ballooned since 2021.

Declining Repo balances is money making its way into the financial system (QE). From mid-June till the end of October, this was largely offset by a rising General Account (roughly net neutral). But since the General Account was replenished back to the more historical balance of $700-800 billion and given the Repo market keeps declining, this equated to QE since mid-October and into November.

Final Thoughts

We are not saying the cooling inflation plus softer economic data bringing down bond yields isn’t the main good news story of this recent rally. It likely is, and it is really good news. But stimulus has increased the magnitude of the gains. So what happens next? The Repo market, which before 2021 was near a zero balance, could continue to drain. At $1.26 trillion, it still has a ways to go. If the General Account remains stable, any faster draining of the Repo above $50B per month to offset the Fed’s balance sheet reduction would be stimulative. So this could have further legs, perhaps even leading to that Santa Claus rally many like to talk about.

Alternatively, if the draining of the Repo slows or if bond yields stop heading lower, this market rally may run out of steam, becoming more of a Turkey rally (American Thanksgiving Turkey, that is). Wouldn’t stand in the way of it, but this is a renter’s rally. Especially given earnings revisions have turned flat to slightly negative and economic data is softening, making the underlying foundation not so solid.

— Craig Basinger is Chief Market Strategist at Purpose Investment

Disclaimer

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.