When we say “orderly,” we are not downplaying the volatility or pain—simply saying the market was being repriced. Even most investors were relatively apathetic to the declines. Whether that was because of some outsized gains in the previous year and a half, or recency bias that this bear would be similar to 2020 (i.e., down fast and back up, blink and you missed it), apathy has given way to emotions once again.

If you can characterize bear markets, moving from repricing or multiple contraction to more emotional-driven behaviour is a natural progression. As we see money flowing very quickly into cash proxies and product, it is clear the apathic patience of the first phase has given way to classic run-and-hide behaviour.

As emotions are now elevated, the risk of a capitulation event is much higher. The good news is this would likely mark the bottom of the bear market, the bad news is it likely has not occurred yet. Nonetheless, this market is fragile. It has absorbed the Fed going from about 0% to now pricing in 4.5% in Q1 of 2023. Bond yields globally have risen. And don’t forget global bonds have now erased $125 trillion in wealth while global stocks have erased $30 trillion. These are measured in U.S. dollars (USD), so exaggerated by the rise of USD vs all other currencies, but certainly a negative wealth effect is afoot.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used herein under a non- exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

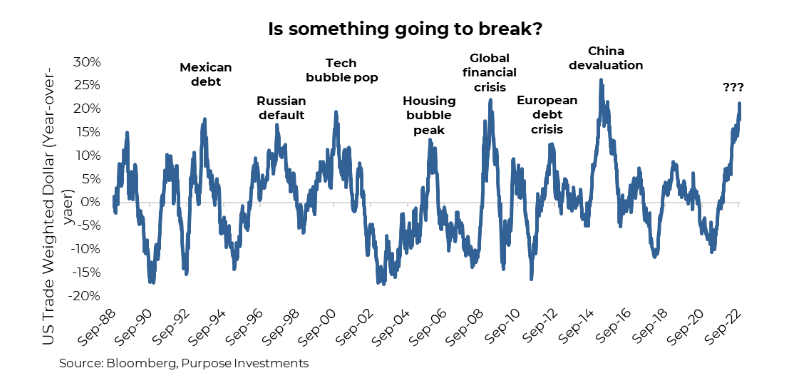

Talking about the USD , this too is applying much pressure to the markets, financial systems, and many economies. The above chart is the year-over-year change in the U.S. trade weighted dollar (USD vs a basket of other global currencies). A rise in the USD similar to the last few months has coincided with many of the past market events that really roiled markets.

We should point out this may be a cart-in-front-of-horse or horse-in-front-of-cart scenario . Does the USD spike because of a crisis or does the spike help cause the crisis? This is important because so far there does not appear to be a crisis or breakdown in the market. (Yet…anyhow.)

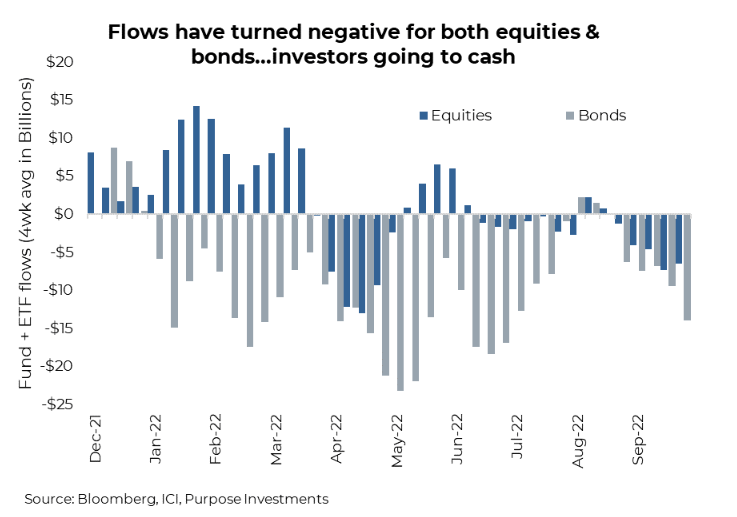

Fund flows are certainly adding to the stress, measured by mutual fund & ETF flows. This is U.S. data, but it is similar in Canada. Bond outflows have remained pretty resilient this year as investors flee higher yields—effectively selling low, but the mob is the mob.

Equity inflows remained during the early months of this bear market as the buy-the-dippers tried one more time. But that cohort appears spent and flows have turned negative in September. If you are wondering where the money goes, it is cash. Cash vehicles have been ballooning.

This is precisely the same behaviour we can witness in any bear market. And while it may feel good and even be right with a potential event ahead, the market outflows and cash inflows ALWAYS persist for quarters and even years after the markets’ bottom.

Remember, as investors, if it feels good, you are likely doing it wrong.

Portfolio Construction

2022 has not been an enjoyable year for investors, nor for advisors, and certainly not for portfolio managers. And the risk of some sort of event that triggers a final capitulation is high, given emotions and stresses in the markets and economy. And while the bottom does not appear to be put in just yet, we are likely getting must closer to the final bottom.

Does it need a final capitulation? Perhaps, but that’s not a certainty. Could an improvement in U.S. inflation data out next kick off a strong rally in both equities and bonds? Perhaps… The various paths forward from current levels are very divergent, which makes going in on risk assets or going to defensive cash both potentially perilous.

While an event may be looming, we would also note that the TSX is yielding 3.4% and trading at only 11x earnings. This was the valuation trough during the 2020 pandemic. Much bad news is priced into many markets, including the bond market.

This is a dangerous time to make any outsized bets.

Stay diversified and if you look forward 12 months, even with a potential recession, both equities and bonds likely have a higher probability of being higher than today’s levels. But the path from here to there will likely be a wild one.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.