At the root of this bear market is inflation, so finally, a sign of improving inflation has a very strong market response. Especially given the preponderance of negative news over the past few months, the market is kind of like a spring sometimes. Inflation starting to come down was always a ‘when,’ not an ‘if,’ and that CPI report did carry a lot of good news. Food inflation came down, which is nice. The core, ex food & energy, was 0.3% for the month, which was below the 0.5% expected and below the 0.6% from last month. There was a decent amount of good news – rent inflation slowed, while outright price drops were evident in clothes, car prices, airfares and durable goods in general. Lodging away from home (aka hotels) was up a lot. Overall, a good report.

✓ Inflation – has shown signs of slowing.

✓ Midterms – we don’t focus on politics much as guessing the direction is hard and how the market may respond even harder. But without the red wave that was expected, U. S. politics may be back to a lame-duck period, unable to implement much on the policy side. This reduces policy uncertainty which markets like.

✓ China – it may prove premature, but there is an optimistic tone in the market on the potential relaxing of zero-covid policies in China. This policy has suppressed the world’s 2nd largest economy, and relaxing would have a meaningful impact on global economic growth. Previous periods of optimism fizzled so hard to say. But Hong Kong has popped 18% so far this month, and global cyclicals have rallied as well.

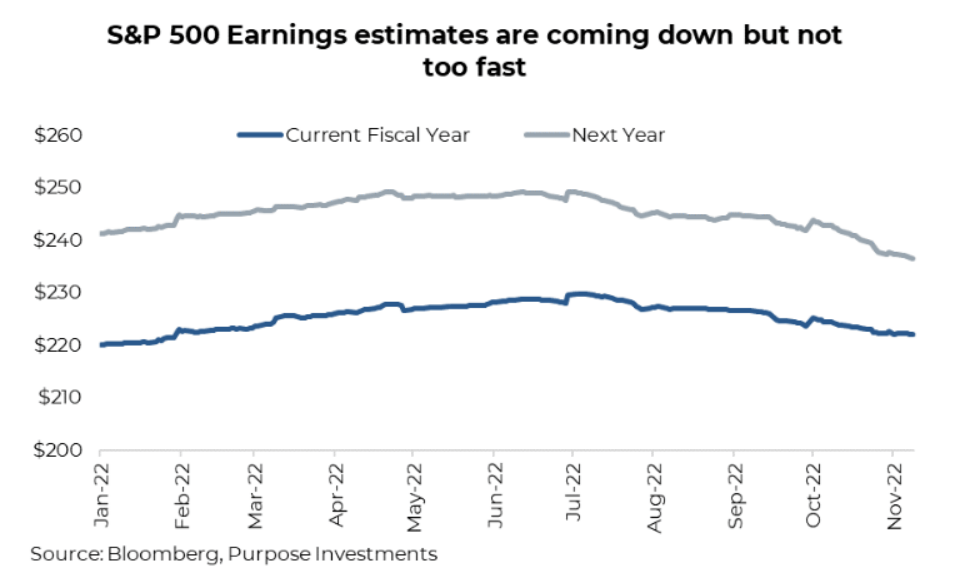

✓ Earnings – not saying the Q3 earnings season was a home run, but it wasn’t bad, either. The frequency of positive earnings and sales surprises was within historical norms. The magnitude of the surprises was lower, and growth has been slowing. Still, things didn’t fall off a cliff, and forward estimates may be falling but only marginally so far.

The other good news is there shouldn’t be much news ahead. Past CPI, labour report, Fed, earnings, election, etc. In a world that does tend to have more bad news than good, a light news period is a welcome development. We have been saying for a while that when inflation rolls over, this market will bounce, and that bounce appears to be in motion. If you are an optimist, perhaps call it a Santa Claus rally. If not as optimistic, maybe a U.S. gobble gobble rally.

Portfolio Construction

This rally could have some legs, much like the one in the summer that was kick-started by optimism around inflation and a better-than-expected earnings season. Markets have been oversold, and a light news period may help. Of course, the million-dollar question is whether the bear is over, which we do not believe to be the case. The higher and faster this market ascends, the less financial conditions tighten, which could elicit less of a pivot from central banks. Plus, valuations become a headwind when combined with negative earnings revisions.Of course, when the bear does end, everyone will doubt the rally as it will be built on more hope than anything fundamental. We remain market-weight equities as the downside vs upside risks appear balanced…for the time being. Now back to enjoying the markets; it is a welcome change.

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only. This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.