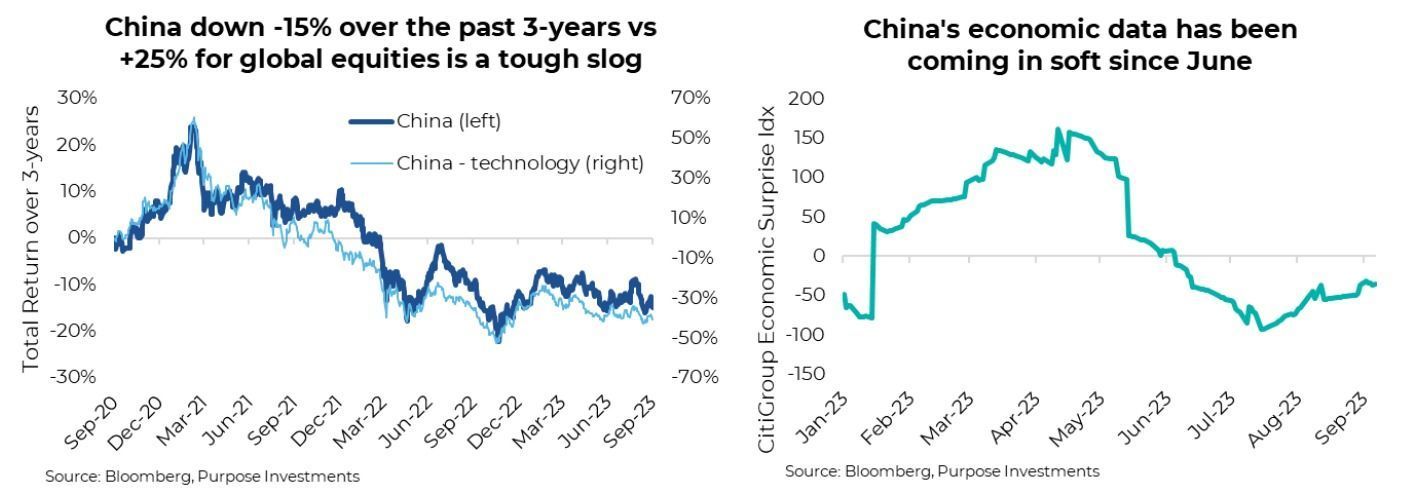

There’s no denying the Chinese stock market has had a tough go. Over the past 3-years, the Shanghai Shenzhen CSI 300 index is down about 15%. This compares to a time period when global equities have risen 25%. And if you adjust to common currencies, it gets even a bit worse. China’s equity market has certainly endured some bad news over the past few years. Their housing industry is in a multi-year corrective phase, and covid lockdowns didn’t help either. However, China’s market has something in common with the U.S. – as goes tech, so goes the market.

While Chinese technology companies certainly see bigger swings than the overall market, pretty much all the peaks and troughs line up (1st chart). This means that if you are either bullish or bearish on China’s equity market, it is primarily a call on their technology companies. It is worth pointing out that Chinese tech companies suffered similarly to U.S. tech in 2021 and 2022. But U.S. tech rebounded HUGE this year while China tech failed. Semiconductor constraints and global investor risk appetites have probably led to much of this divergence. Given we are not bullish even on U.S. tech, it is even harder for us to get excited about China tech, which is more support for our low or near non-existent exposure to emerging markets.

This is where things get a bit more challenging and divergent. You don’t need an economics degree to decipher that consumer-related activity is holding up OK in China; manufacturing is weak, and real estate is even weaker. The consumer has become more important for China’s economy over the past decade as the percentage in the middle-income bracket has risen. Encouraging on the surface, retail spending is up 7.3% so far this year compared to this point last year. That does sound incredibly strong, but this is being compared to covid lockdown periods. So it should be up nicely. Unfortunately, compared to dollar levels before the lockdowns, its pretty flat, which is not good. On a positive sign, Macau gambling revenues are rising, still well below pre-pandemic but certainly closing the gap quickly.

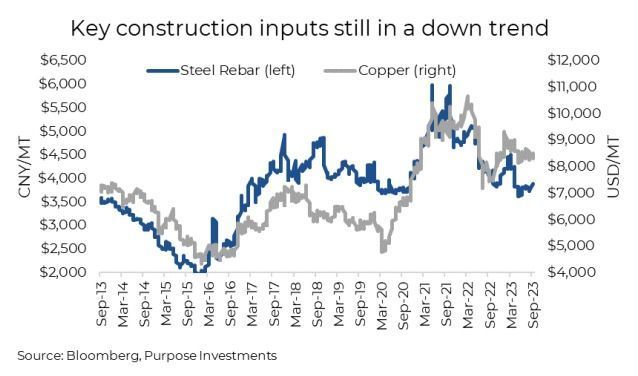

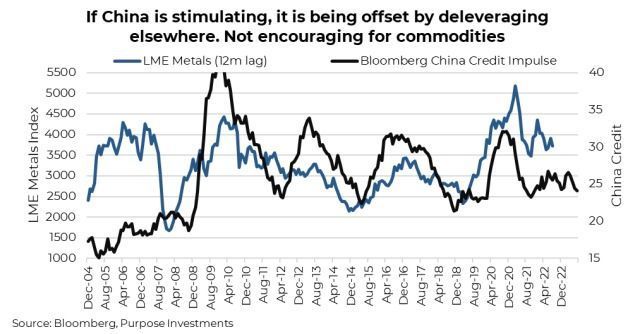

Real estate is not good. And a real estate crisis is a common byproduct of extended periods of economic advancement that lifts much of a population into the middle class or better. It happened in Japan, it happened in S. Korea, and it happened in many of today’s developed economies if you look back far enough. This could be China’s turn. Many signs are there, from loose building standards, excess debt among developers, and leverage among consumers. It is difficult to say how long this could last, and government stimulus/intervention is certainly evident. Our preferred index to watch is one we created two years ago that tracks the average price return of real estate developers listed in China and Hong Kong. The premise is straight forward: the stocks will turn ahead of any improving sign in the economic data or elsewhere. So far, there’s not much to be optimistic about. And yes, this index has lost over 60% of its value in a couple years.

Final Thoughts

Valuations in China’s equity market are low, and perhaps this mitigates the risks somewhat, but not enough for us. Currently we remain with a negative view on emerging markets and that certainly includes China. More importantly, it’s the economy. A slowing China, should it continue, will be yet another headwind for the global economy. And while the slowdown could be classified as ‘little’ at the moment, given the size of China’s economy and consumption, a little trouble matters.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.