Seniors: Don’t Overlook the Value of the TFSA!

November 28, 2022

What makes the Tax-Free Savings Account (TFSA) a compelling investment vehicle for seniors?

Unlike Registered Retirement Savings Plans (RRSPs), contributions can continue beyond the age of 71.

1

TFSAs also offer flexibility in withdrawals — there are no limitations on timing and withdrawn amounts can be recontributed in the following calendar year. Withdrawals do not generate taxable income, so they won’t affect income-tested benefits such as Old Age Security (OAS).

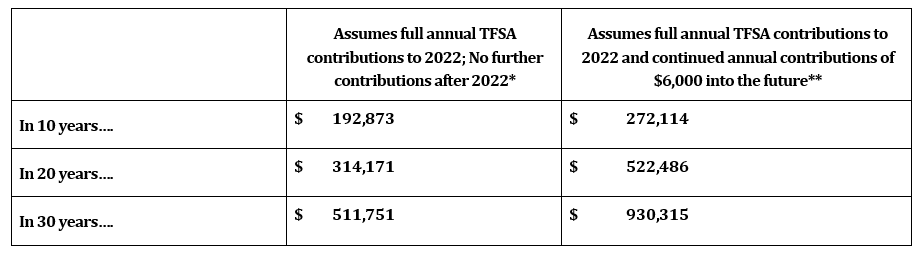

Consider that a 65-year-old who has fully contributed to the TFSA since its inception could accumulate a tax-free amount of around $500,000 by the age of 85, assuming a 5 percent rate of return and continuing annual contribution of $6,000 — a significant amount, by any standard!

Strategies to Fund the TFSA

It may be challenging for seniors who are not working to contribute to a TFSA. However, even with limited income, there may be two viable options: i) using net (after-tax) RRIF withdrawals; or ii) using non-registered investments to fund the TFSA.

For seniors who have a lower marginal tax rate today than they expect to have in the future (including at death), if RRIF funds aren’t needed in the future, drawing RRIF income above the minimum levels 2 may also be a way to potentially lower an overall lifetime tax bill. This is because RRIF withdrawals will be taxed at the current, lower tax rate, instead of at a higher anticipated future marginal tax rate.

If non-registered investments with unrealized gains are used to fund the TFSA, this may result in adverse tax consequences; however, consider that gains realized from non-registered investments could potentially be offset by realized capital losses. As well, the potential for future tax-free growth within the TFSA may be beneficial.

It may be challenging for seniors who are not working to contribute to a TFSA. However, even with limited income, there may be two viable options: i) using net (after-tax) RRIF withdrawals; or ii) using non-registered investments to fund the TFSA.

For seniors who have a lower marginal tax rate today than they expect to have in the future (including at death), if RRIF funds aren’t needed in the future, drawing RRIF income above the minimum levels 2 may also be a way to potentially lower an overall lifetime tax bill. This is because RRIF withdrawals will be taxed at the current, lower tax rate, instead of at a higher anticipated future marginal tax rate.

If non-registered investments with unrealized gains are used to fund the TFSA, this may result in adverse tax consequences; however, consider that gains realized from non-registered investments could potentially be offset by realized capital losses. As well, the potential for future tax-free growth within the TFSA may be beneficial.

In both situations, “in-kind” transfers of securities to the TFSA can help ensure continuity in holdings but, regardless of whether investments are transferred from the RRIF or a non-registered account, there may be potential tax consequences.

3

Keep in mind that the effect on income-tested government benefits (OAS, etc.) should also be considered.

An Important Estate Planning Tool

The TFSA can be an important estate planning tool. The value of TFSA assets at the time of the holder’s death can be transferred tax free to beneficiaries. In provinces other than Quebec, if the TFSA does not pass through the estate, no probate fees will be payable in provinces where applicable. Most important, if a surviving spouse is named as a successor holder, 4 the TFSA can continue to be operated relatively seamlessly by the spouse on a tax-free basis. Any income earned after the holder’s death will continue to be sheltered from tax. 5

1. The RRSP will mature by the end of the calendar year in which the holder turns 71 years old. 2. Withholding taxes will be applied to RRIF withdrawals in excess of the minimum amount. 3. Generally, you will be deemed to have sold these investments at fair market value immediately prior to transferring them (and if transferring investments that have declined in value from a non-registered account, any capital loss will be denied); 4. Not applicable in Quebec, where TFSA beneficiary designations are not named in the plan 5. A successor holder can also make new contributions to that TFSA based on their own contribution room. For more details, see: https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/tax-free-savings-account/death-a-tfsa-holder/successor-holder.html

The TFSA can be an important estate planning tool. The value of TFSA assets at the time of the holder’s death can be transferred tax free to beneficiaries. In provinces other than Quebec, if the TFSA does not pass through the estate, no probate fees will be payable in provinces where applicable. Most important, if a surviving spouse is named as a successor holder, 4 the TFSA can continue to be operated relatively seamlessly by the spouse on a tax-free basis. Any income earned after the holder’s death will continue to be sheltered from tax. 5

1. The RRSP will mature by the end of the calendar year in which the holder turns 71 years old. 2. Withholding taxes will be applied to RRIF withdrawals in excess of the minimum amount. 3. Generally, you will be deemed to have sold these investments at fair market value immediately prior to transferring them (and if transferring investments that have declined in value from a non-registered account, any capital loss will be denied); 4. Not applicable in Quebec, where TFSA beneficiary designations are not named in the plan 5. A successor holder can also make new contributions to that TFSA based on their own contribution room. For more details, see: https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/tax-free-savings-account/death-a-tfsa-holder/successor-holder.html

*At a 5% compounded annual rate of return, since TFSA inception in 2009 and into the future. Assumes that the full annual dollar amount was contributed since 2009 at the start of each year. Assumes no further contributions after 2022, but continued growth at a 5% compounded annual rate of return.

** At a 5% compounded annual rate of return, since TFSA inception in 2009 and into the future. Assumes that the full annual dollar amount was contributed since 2009 at the start of each year. After 2022, assumes a $6,000 contribution amount each year (which may or may not be consistent with future annual dollar limits), at a 5% compounded annual rate of return.

Disclaimers

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.