While there has been little reason to embrace the high inflation we are experiencing today , there may be a silver lining when it comes to certain government benefits. Higher inflation increases Canada Pension Plan (CPP) benefits and the outcome can be especially significant the longer you wait.

The standard age to start CPP is 65, but you are able to begin CPP benefits as early as age 60. In fact, most people start early.1

However, if you have yet to apply for CPP, it may be an opportune time to revisit the timing decision.

How Does Inflation Impact CPP Benefits?

CPP payments are impacted by inflation in two ways. First, like most government benefits, they are indexed to the consumer price index (CPI). The CPP uses the measure of CPI over the 12-month period ending October of the previous year and makes adjustments the following January 1. Second, CPP performs certain calculations based on the year’s maximum pensionable earnings (YMPE), an amount indexed to wage inflation. Over recent times, increases in the YMPE have been significant: 4.94 percent in 2021 and 5.36 percent in 2022. This was largely due to the pandemic when the services industry suffered and fewer people worked in lower-paying jobs, helping to push up average weekly earnings.2

The Timing Decision to Take CPP

If you start receiving CPP benefits before age 65, payments will decrease by 0.6 percent each month to a maximum of 36 percent (if you start at age 60). If you start after 65, payments increase by 0.7 percent each month, to a maximum of 42 percent (if you start at age 70 or after). However, by waiting to take benefits, CPP amounts can grow based on wage inflation, and this is further enhanced by the increased benefit of starting later.

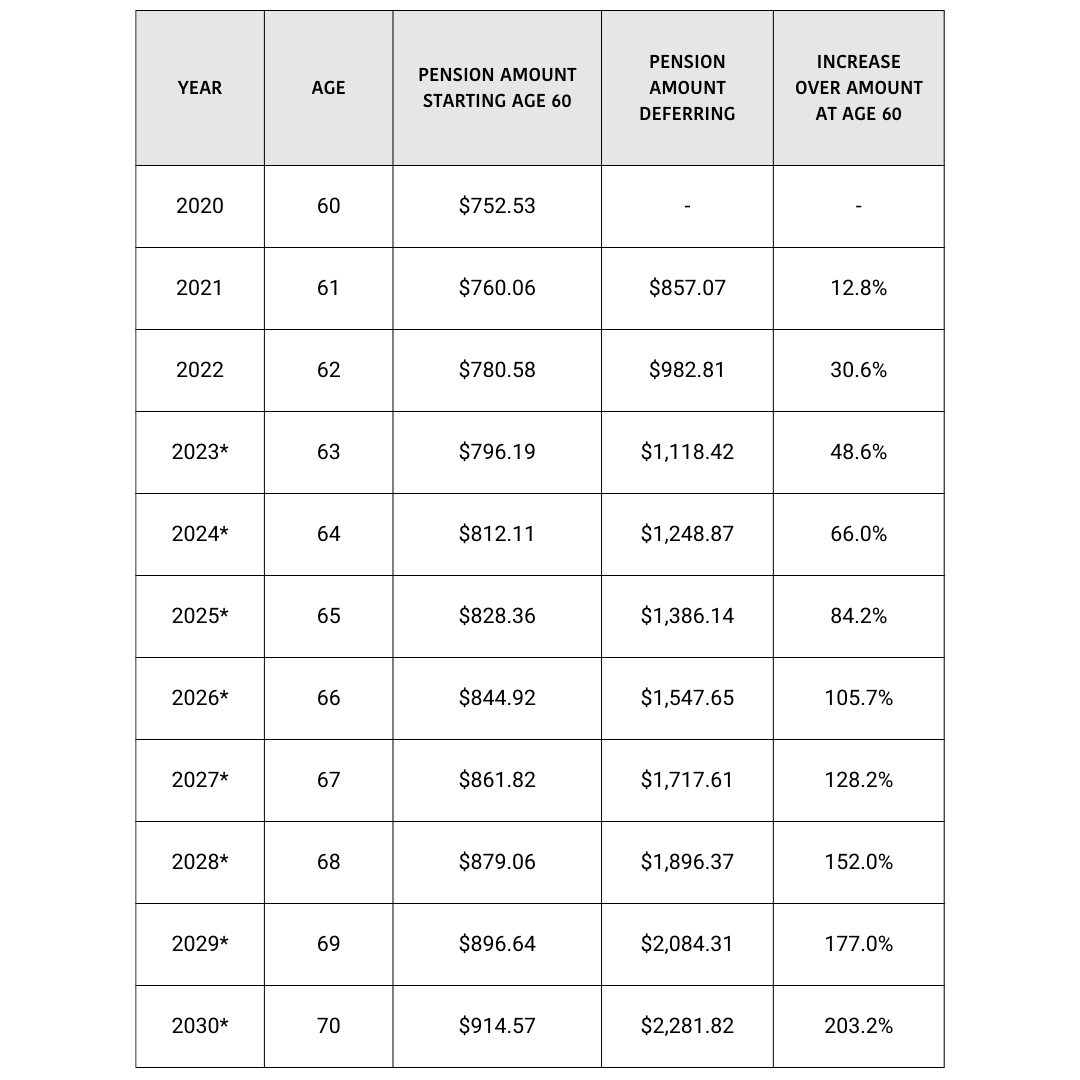

A recent analysis shows the potential impact.

3

It looks at an individual who started CPP at age 60 in January 2020, with a decreased benefit of 36 percent (0.6% X 60 months). Assuming the maximum CPP pension amount of $1,175.83 in 2020, she received $752.53. Had she waited a year and started at age 61, she would have received $857.07 (a 28.8 percent decreased benefit from the 2021 maximum CPP pension of $1,203.75). If she waited until age 62, she would have received $982.81 (a 21.6 percent decreased benefit from the 2022 maximum CPP pension of $1,253.59). By waiting until age 63, she would have received $1,118.42 (a 14.4 percent decreased benefit from the 2023 maximum CPP pension of $1,306.57), which is 48.6 percent more than if she started at age 60.

Just how significant is the difference? The table shows the potential increase over time, based on actual 2021, 2022 and 2023 figures. It assumes future CPI adjustments of 2 percent and maximum retirement pension increases of 3 percent (after 2023), based on existing actuarial assumptions. By these calculations, at age 90 an individual would have a cumulative pension that is 85 percent larger by waiting to start at age 70, compared to starting early at age 60.4

Of course, many factors should be considered when deciding when to begin CPP, including expected longevity, the impact of income-tested benefits, the need for income and more. However, the impact of inflation may be one compelling reason for individuals to consider waiting to begin CPP benefits.

1.

https://financialpost.com/personal-finance/fp-answers-when-should-i-take-cpp;

3. http://www.advisor.ca/columnists_/lea-koiv/consider-inflation-when-deciding-when-to-begin-cpp/; These figures have been adjusted to include actual CPP benefits for 2023;

4. According to this model, by age 90 the retiree would have $381,000 if they started CPP early at age 60, and $706,000 if they started CPP at age 70. The breakeven point is at age 75 when cumulative CPP for the retiree who starts later at age 70 exceeds the retiree who starts collecting CPP early at age 60.

Table: Sample Monthly CPP Benefit for Individuals with Maximum Pension Amount 3

*Estimates after 2023 based on CPI increases of 2% and maximum retirement pension increases of 3% per year, based on existing actuarial assumptions

Disclaimer

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.